Heavyweights from the world’s largest banks and financial institutions, who have descended on Hong Kong for a summit organised by the city’s monetary authority, were welcomed with a banquet at the Palace Museum on Monday evening.

The Hong Kong Monetary Authority (HKMA) hosted 300 global bankers at the landmark museum in the lead up to the second edition of its Global Financial Leaders’ Investment Summit, which takes place over the next two days. Guests were treated to a cocktail reception followed by a Chinese banquet-style meal and cultural performances.

Henry Tang Ying-yen, the West Kowloon Cultural District Authority chairman and financial secretary from 2003 to 2007, spoke at the welcome dinner, while HKMA CEO Eddie Yue Wai-man welcomed the guests in his address. The museum is holding a number of exhibitions, including works by Botticelli, Van Gogh and treasures from the Sanxingdui archeological site in Sichuan province.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

“Art is not just art,” Tang said. “It is not just a visual culture. Art is actually finance. Private banking, wealth management today is a huge business, and it is very balance sheet efficient. I know many banks are looking to Hong Kong as their platform for wealth management and asset management, and we are an ideal platform.”

Financial Secretary Paul Chan arrives for the welcome dinner of the Global Financial Leaders’ Investment Summit at Hong Kong Palace Museum. Photo: Sam Tsang alt=Financial Secretary Paul Chan arrives for the welcome dinner of the Global Financial Leaders’ Investment Summit at Hong Kong Palace Museum. Photo: Sam Tsang>

About 90 CEOs and chairmen are attending this year’s event, more than double last year’s number. Heavyweights from Morgan Stanley, Standard Chartered, Citigroup, Blackstone, UBS and JPMorgan Chase are among the invitees.

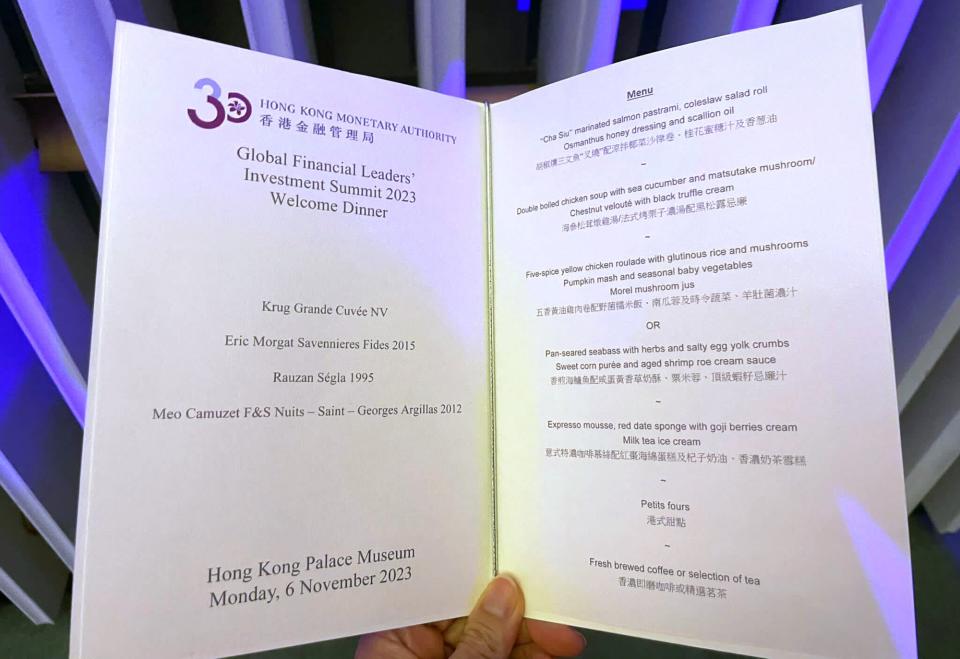

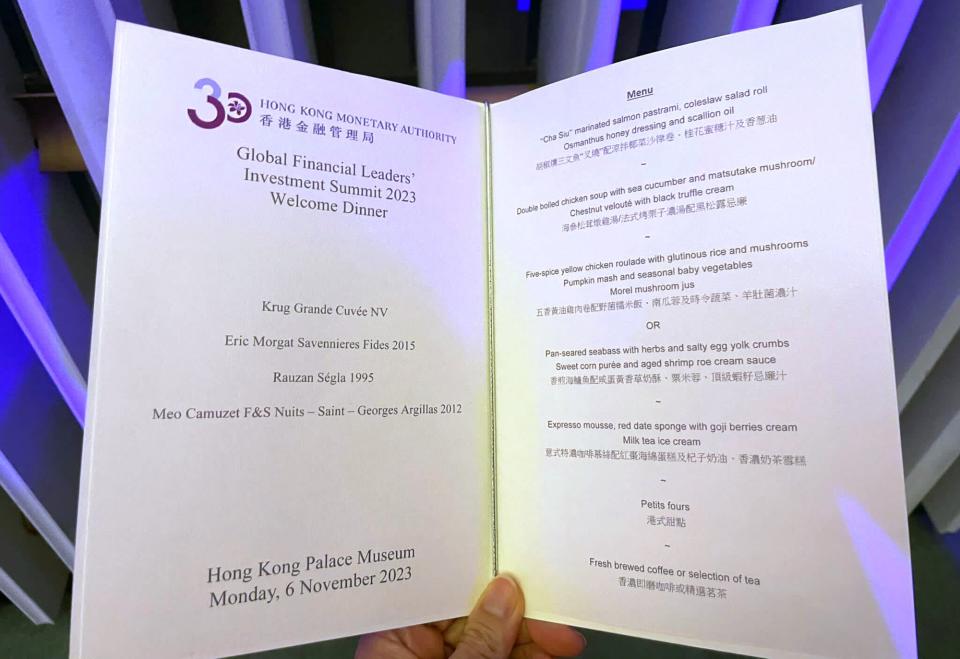

At the welcome dinner, guests enjoyed a four-course modern Chinese banquet meal. The entrees were char siu-style pastrami salad rolls and doubled boiled chicken soup. The choice of mains included five-spice yellow chicken and pan-seared seabass.

Espresso mousse with red date sponge cake and milk tea ice-cream rounded off the Cantonese inspired menu. Last year, the banquet was held at the M+ Museum.

The wines served at the banquet was sponsored by Tang, an avid wine collector, who abolished tax on it during his tenure as financial secretary.

Starting with a Krug Grande Cuvee non-vintage champagne, the wines began with 2015 Saviennieres Fides by Eric Morgat from the Loire Valley, followed by a 1995 Bordeaux by Ch. Rauzan-Segla, and finished with a 2012 Nuits-St Georges Aux Argillas Premier Cru from the Burgundy region.

The dinner menu of the Global Financial Leaders’ Investment Summit. Photo: Handout alt=The dinner menu of the Global Financial Leaders’ Investment Summit. Photo: Handout>

“I hope you will enjoy the wines because otherwise I will drink them myself. Excellent champagne, please start with that,” Tang said.

Many banking executives will be appearing on discussion panels, which will delve into the opportunities and complexities in the post-Covid-19 economy.

The emphasis of this year’s summit is “Living with Complexity”, as the world moves on from last year’s theme of “Navigating Beyond Uncertainty”, Yue said in a recent interview with the Post.

The event comes on the back of FinTech Week, where the HKMA announced the digital payment systems developed by Hong Kong and Thailand would be ready for use in the two jurisdictions from early next month.

Market trends, including the development of fintech and opportunities for traditional banks to tap digital innovations, are expected to be among the main talking points at the conference.

Mitigating risks amid a global economic slowdown and tightening financial conditions will also be high on the agenda. China’s post-Covid recovery has turned out to be slower than expected and global investors have been offloading Chinese stocks at a record pace during the past three months amid a lack of stimulus measures and rising geopolitical tensions.

China’s uncertain outlook has badly affected the Hong Kong stock exchange. The bourse saw 28 companies raise US$2.2 billion via initial public offerings (IPO) in the first half of the year, a two-decade low, according to Refinitiv data.

Later this month, the Bank for International Settlements (BIS) will host its annual governors’ meeting along with a forum on November 27 and 28, coinciding with the HKMA’s 30th anniversary.

The bankers’ summit and the BIS meeting are part of Hong Kong’s efforts to show the world that the city is back to normal after three years of disruptions caused by the pandemic.

A special fireside chat has been organised on Tuesday to wrap up the first day of the bankers’ summit.

The government has yet to confirm whether the Global Financial Leaders Summit will be held again next year, as it may be reserved for only special occasions, rather than being an annual event.

Additional reporting by Jiaxing Li and Enoch Yiu

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2023 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2023. South China Morning Post Publishers Ltd. All rights reserved.