MAASTRICHT, The Netherlands — The European Fine Art Fair, held on the outskirts of this historic Dutch city, has for almost three decades been the world’s pre-eminent commercial event devoted to pre-21st-century art and objects.

But the dealer-organized fair, known as Tefaf, whose 29th edition opened on Thursday and runs through March 20, faces challenges, as do other sectors of the luxury goods market. The global economy has been volatile following the slowdown of growth in China, cooling demand in the art market. And while Tefaf’s traditional strengths in old master paintings and antiques might appeal to the more than 250 curators from museums like the Getty, the Metropolitan Museum of Art and the Louvre who regularly attend, the majority of private collectors now prefer more recent art.

These shifts were underscored on Wednesday when the fair’s umbrella organization, the European Fine Art Foundation, released its annual Art Market Report.

Global sales of art declined nearly 7 percent, to $63.8 billion in 2015 from $68.2 billion in 2014, according to the report, the industry’s only comprehensive overview of world auction and dealer transactions (the latter based on estimates).

Sales of postwar and contemporary art represented 46 percent of these sales by value, with modern works making up 30 percent. European old masters — a specialty of at least 50 of the 276 dealers exhibiting at this year’s Tefaf — accounted for just 4 percent.

“There’s an element in the old master trade that’s slightly in denial and doesn’t want to face up to weakness in the market,” said Hugo Nathan, a co-founder of the London art consultants Beaumont Nathan. But, he added, “the market is robust for top-quality exciting fresh material.”

A shortage of fresh material has always been a systemic problem for the old master market, and at Tefaf dealers make a conscious effort to unveil discoveries.

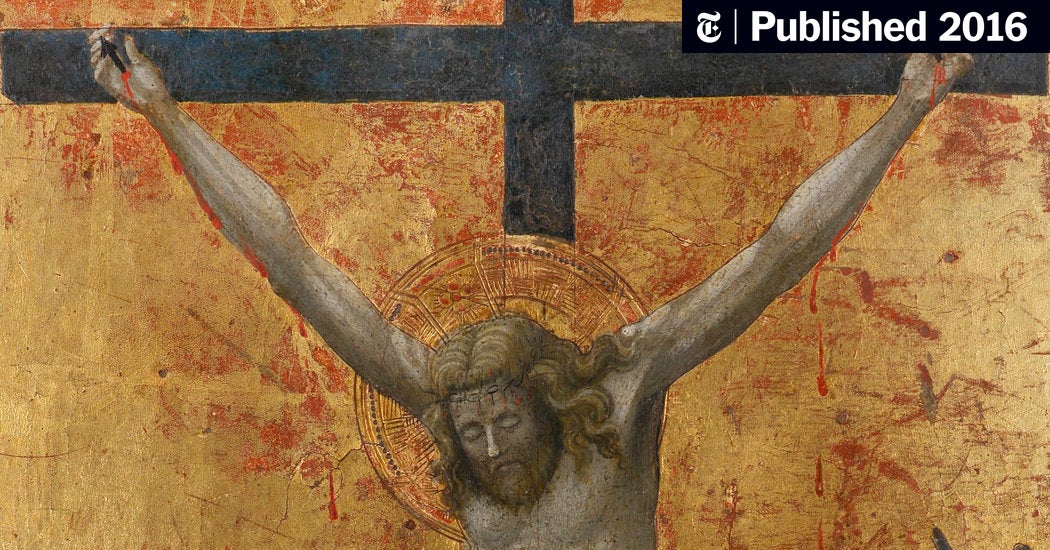

One the most spectacular is a moving and finely preserved early 15th-century gold-ground painting of the crucifixion by Paolo Uccello being shown by the London dealers Thomas Agnew’s, priced at 5.5 million euros, about $6 million.

Paintings by this important Florentine artist are all but unheard-of on the open market. Acquired by Agnew’s from a private collection, the circa 1423 panel has been recently identified by scholars as an early work by Uccello painted in a medieval style before (as Giorgio Vasari put it) he “drove himself mad” with the study of perspective.

This slightly atypical work by one of the great names of Renaissance art will test the fair’s continuing ability to find buyers for top-level old masters.

A 13-foot-wide Luca Giordano painting, “The Calling of Saints Peter and Andrew,” from 1690 and priced at €2 million at the booth of the London dealer Colnaghi, was one of the few big-ticket old masters sales at the Thursday preview.

The Paris dealership Galerie Talabardon & Gautier is showing Rembrandt’s “Smell,” one of five panel paintings of the senses made by the artist in the 1620s while still a teenager. The painting, which is not available for sale, was bought in September by the French dealers as “continental school, 19th century” for $1.1 million with fees at an auction in New Jersey. It was subsequently identified as an early Rembrandt and sold to the American billionaire Thomas S. Kaplan for about $2 million, according to a dealer with knowledge of the matter who spoke on the condition of anonymity.

The London dealer Fergus Hall is also showing an auction “sleeper.” He bought a monumental early 17th-century canvas of Hercules at Sotheby’s in 2014, described as “Jusepe de Ribera and workshop” for 350,500 pounds, about $500,000. Now widely, if not unanimously, accepted as the fourth known “Giants of Antiquity” painted by the artist himself, it is priced at $4.8 million. Like that early Rembrandt, the Ribera underlines the potential profits that can still be made by discoveries in the old master market.

The Tefaf report describes the art market in 2015 as “highly polarized,” with most of the value in sales of postwar, contemporary and modern art at “the very highest price levels.” While overall sales in Britain declined 9 percent in the past year, and in China 23 percent, those in America increased 4 percent to $27.3 billion, representing 43 percent of the global value.

In response to the growing dominance of American collectors and museums, Tefaf announced last month that it would be holding two “mini Maastrichts” in New York at the Park Avenue Armory.

Tefaf New York Fall, devoted to more historic works, will open in October, while Tefaf New York Spring, focusing on modern art and design, is scheduled for May 2017. Both events will include about 80 to 90 exhibitors.

Tefaf’s enterprise has been widely applauded, but will the presence of these fairs obviate the need for Americans — 2,500 of whom attended last year, of the fair’s 75,000 visitors — to go to Maastricht?

“It will be good for the New York market,” the Tefaf exhibitor Otto Naumann, an old-master specialist there, said of the October event. “New York is the center of competition and dealers who can’t get into the fair will be exhibiting in the galleries. But it could possibly have an erosive effect on Maastricht. There are fewer Europeans buying.”

Tefaf Maastricht continues to have some weak areas – this is not the fair to buy cutting-edge contemporary art, and a clash of dates with Asia Week in New York has seriously depleted representation by top dealers in Chinese ceramics and other works of art – but the sheer wealth here of startling, museum-quality objects continues to amaze, as do some of the prices.

The Swiss book dealer Heribert Tenschert Antiquariat Bibermühle is asking €12 million for a hitherto unknown early 15th-century illuminated manuscript by the Limbourg Brothers, famed for the “Très Riches Heures” made for Jean, Duc de Berry. Containing 30 pen and silverpoint drawings, the manuscript had been bought by Mr. Tenschert in 2013 for €2.7 million at an online auction in Belgium.

One of the few exceptional works in the 51-dealer modern section of the fair is a circa 1950 painted plaster corset by the Mexican artist Frida Kahlo presented by the Uruguayan dealers Galeria Sur. This widely exhibited object, painted with a hammer and sickle and an image of an embryo in a womb, is priced at $3.5 million, on consignment from a collector.

The Kahlo did not hook a buyer at the preview, but at least half a dozen collectors expressed strong interest in the six-foot-eight-inch-high nail painting, “Weiss (White),” by the Zero Group artist Günther Uecker, priced at $2 million by the Italian postwar art specialists Cardi. The 1988 work was sold to a European buyer at the preview.

The Tomasso Brothers of London have reunited 17th-century Roman polychrome marble busts of Horace and Cicero that in the early 18th century were part of the Eighth Earl of Pembroke’s famed art collection in the “Double Cube” room at Wilton House in Wiltshire.

They were found in original condition, coincidentally, in separate collections in America and France in December and January respectively, and are marked at €1.75 million for the pair.

Dino Tomasso, one of the two brothers who founded the dealership, said he was confident of Tefaf Maastricht’s longevity, despite shifts in fashion and its ventures in America.

“When you look around you see dozens and dozens of world class objects,” Mr. Tomasso said. “It’s the crème de la crème. It will always be the mother ship.”