These days, the investment world seems more prone to fads and fashions than ever before, but it really jumped the shark with non-fungible tokens.

NFTs were so hard to explain that cryptocurrencies seemed a model of simplicity by comparison, while the irrational mania they unleashed made overblown meme stocks such as GameStop and AMC Entertainment look like steady, sensible trades.

Absolutely nobody who has read anything about NFTs will be surprised to learn that after prices rocketed to the stars in 2021, the direction of travel has subsequently been the other way – and at a similar speed. In technical terms, they have tanked.

So, can we consign NFTs to history alongside other irrational bubbles such as tulip mania and the metaverse, or is there a sensible idea lying in the rubble?

For those still wondering, Wikipedia describes an NFT as “a unique digital identifier that is recorded on a blockchain, and is used to certify ownership and authenticity”.

It cannot be copied, substituted, or subdivided, which makes it a handy mark of ownership, allowing NFTs to be sold and traded.

Art, music and magical sports moments were all packaged up as NTFs and sold to the highest bidder.

For a while, they fetched huge, ridiculous sums. In March 2021, a bidding war drove the cost of buying Twitter founder Jack Dorsey’s debut tweet to a staggering $2.9 million.

An NFT collection of cartoonish monkeys called Bored Ape Yacht Club went for up to $429,000 each, while a basketball fan paid $387,600 to secure ownership of a LeBron James slam dunk against the Houston Rockets, part of the NBA Top Shot Moment series.

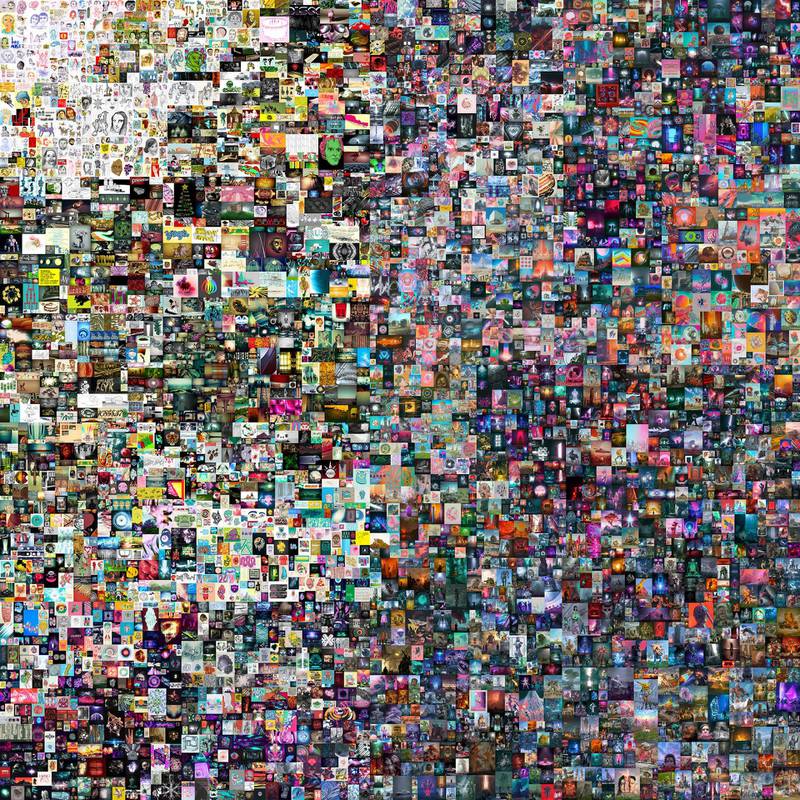

Artists showed they had an eye for commerce, too. Famously, digital artist Michael Joseph Winkelmann, known professionally as Beeple, auctioned an NFT of his work Everydays: The First 5000 Days at Christie’s. Originally priced at $100 it went for $69.3 million.

Whatever your view of Beeple’s art abilities, few can dispute his financial acumen. He was paid in Ethereum but instantly converted the lot into US dollars.

Celebrities got swept up in the trend including Snoop Dogg, Paris Hilton, Lindsay Lohan and Justin Bieber. Madonna, naturally.

This level of insanity was only going to end one way.

Last year, as inflation surged and war in Ukraine raged, the Bitcoin price crashed by three quarters to $16,600 and took NFTs down with it. Monthly trading volume plummeted by 81 per cent between January 2022 and July 2023, DappRadar data shows.

It is not known how much the Everydays NFT would auction for today, but here is a clue.

Last year, Sina Estavi, chief executive of Bridge Oracle and the purchaser of Mr Dorsey’s tweet, tried to resell what he once called the “Mona Lisa of the digital world”. He called off the auction with bidding at $14,000.

At least his money went to a good cause, as Mr Dorsey had donated Mr Estavi’s £2.9 million to charity Africa Response.

As with every bubble, real money is lost.

While cryptocurrencies have stabilised in 2023, NFTs are still struggling, says Vijay Valecha, chief investment officer at Century Financial, who, no doubt, speaks for many – if not the majority – when he says “the drastic fall in NFT prices confirms that they are nothing more than a passing fad with an uncertain future”.

When assets are bought primarily for speculative purposes rather than their intrinsic value, the bubble will always burst.

“It didn’t help that the NFT market was quickly saturated with low-quality, trivial assets,” he says.

The digital world changes rapidly and an “overhyped niche concept” such as NFTs is particularly vulnerable, Mr Valecha adds.

“Concerns about the environmental impact of blockchain technology, which underlies NFTs, also cast a shadow and the pain may not be over yet.”

Fears of a regulatory clampdown are not helping, with the US Securities and Exchange Commission now looking at the sector.

The early excitement over NFTs in Silicon Valley was similar to the gold rush, says Leo Smigel, founder of Analyzing Alpha, an algorithmic trading specialist. “Everyone wanted in, but not many knew what they were getting into.”

What the sector lacked was a solid use case for the average consumer. “NFTs haven’t found their killer app yet, but to say they’ll vanish into oblivion is too simplistic.”

Mr Smigel says NFTs have opened doors to applications we have yet to even think of in collectibles or decentralised finance, for example.

“Now, they need to prove their worth, like a rookie athlete who had a stellar first season but has to deal with a sophomore slump.”

NFTs are down but far from out, says Hadley Chilton, partner in financial restructuring and asset management specialist Cork Gully.

A number of large brands have a practical use for NFTs and smart contracts, where proving something is important.

“They can use them to enhance their loyalty schemes, improve supply chain data, ESG [environment, social and governance] reporting and audit, or to democratise certain asset classes such as high-value real estate. These offer much better prospects than owning a digital receipt for a trending cartoon picture,” Mr Chilton says.

Watch: Boy, 12, makes $500,000 creating and selling NFTs online

Boy, 12, makes $500,000 creating and selling NFTs online

Chris Trew, chief executive of blockchain development platform Stratis, sees opportunities in the video games industry.

“In traditional games, players collect items by achieving new levels or winning battles. Imagine if you retained ownership and could convert these digital assets into real-world monetary value,” he says.

Alternatively, gamers could, for example, transfer their NFTs to another game.

“A player might be rewarded for successful gameplay by earning a unique piece of armour or a weapon, which is only available to others if it is for sale. It could supercharge demand for certain games.”

NFTs could also help the ticketing industry combat risks such as fraud, loss and touting, and allow agencies and artists to earn a percentage where tickets are resold.

“Tickets can become collectables, while holders might gain access to exclusive content like swag, VIP access and loyalty programmes. We are already seeing interest from events organisers and venues,” Mr Trew says.

Tom Grogan, chief executive of emerging tech strategic consultancy MDRx, says the NFT sell-off was “just the market sorting and valuing NFTs according to their merits, which have irritatingly been low or non-existent to date”.

He says the crazy hype cycle is mercifully over but the technology is still standing. “We will see more nuanced, intelligent applications from gaming assets to industrial supply chains and ticketing, properly interrogated on a case-by-case basis.”

The NFT bubble has played out in the usual way, but as we saw after the dot-com meltdown at the start of the millennium, a crash is part of the process and the underlying concept may still have a bright future. After all, we are still using the internet.

Updated: September 16, 2023, 3:55 AM