Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Which stage of a bubble is this?

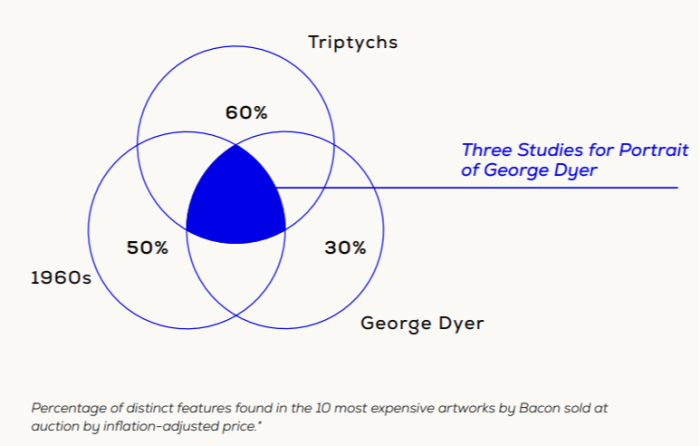

The above chart is in the supporting bumf around a much-delayed plan to float a painting. Lichtenstein-based Artex will next week list Art Share 002, the maiden stock on what it hopes will become the world’s first exchange for high art.

Artex aims to raise $55mn via a private placement and use the proceeds to buy Three Studies for a Portrait of George Dyer, a Francis Bacon triptych described on page 36 of the preliminary offer memorandum:

Set against an enigmatic, dark backdrop, Dyer’s figure seems to emerge from the depths of his psyche, a visual representation of inner turmoil and existential angst. Bacon’s distinctive treatment of flesh, often evoking raw meat, is not merely a stylistic choice but a profound reflection on mortality and the ephemeral nature of human existence.

Etc.

The painting’s current owner, “a private collector” identified in the documents as Codelouf Limited, paid $51.7mn in a Christie’s New York auction in 2017. Codelouf is a Guernsey-registered company that has been linked to the family of Count Luca Rinaldo Contardo Padulli di Vighignolo, a financier known for his extensive collections of art and British leasehold property.

Prince Wenceslas of Liechtenstein founded Artex in 2020 in partnership with Yassir Benjelloun-Touimi, a former CDS trader and hedge fund manager. Last year their company borrowed $55mn from Codelouf and simultaneously agreed to buy the Bacon triptych for the same amount. Cash raised by the share sale (net of approximately $4mn in fees and expenses) will clear the debt and complete the purchase. If investor interest falls short, Codelouf will take surplus shares in lieu of up to 25 per cent of the loan value.

Artex first announced its Bacon float in May, having gained approval from the Liechtenstein regulator to launch an art exchange last January. Trading was due to start in July but, going by the Artex website, the plan had to evolve quite a bit.

The company says in an “important corrective statement to prospective investors” that it needs to address misinformation “disclosed via publicly available media”:

After thorough investigation and detailed analysis of the information disclosed on the internet and in the articles and videos in question, the Company has endeavored to cause the removal of the relevant information from the internet, the articles and the videos.

That might all seem a little coy, since the relevant information in reports (including the FT’s) repeat Artex regulatory announcements. The videos presumably include Benjelloin-Touimi’s many media appearances to discuss fractionalised art investment, including on Bloomberg TV and PBS.

In May, Artex said in a press release that the Bacon share sale would be an “offering to the public”, but has had to clarify that it’s a private placement. Also in May the company called Art Share 002 “a securitisation vehicle governed by the Securitisation Law of Luxembourg”, but has had to clarify that neither its exchange nor the share sale are subject to approvals from the Luxembourg regulator. More than once it named Rothschild & Co as financial adviser, but has since said Rothschild is not involved.

Also:

The Offered Shares will represent a share in the share capital of the Company and will not constitute, nor represent, any directly share or ownership in the Artwork that will be purchased with the proceeds of the Offered Shares;

Common shareholders of Art Share 002 can claim part ownership of the painting’s ultimate resale value via a second-class share in the special-purpose vehicle, with an Artex-owned corporate agent handling all management functions. A dual-class shareholder structure gives Art Share 002’s three-person board powers to keep the stock listed on Artex exclusively, and to veto “any joint venture, partnership, profit sharing agreement, consolidation, amalgamation, liquidation process, dissolution of the Company and/or major project”.

Artex has pledged to backstop all operating costs, which is important because Art Share 002 . . .

does not expect to generate revenues or cashflows from lending the Artwork to museums for free. The Company will not conduct any business activities except for activities relating to the ownership, maintenance and promotion of the Artwork, to the extent that such activities shall be limited to a passive administration of the ownership of the Artwork. The strategy will be to display and promote the Artwork in a manner designed to improve public understanding of it.

. . . and the responsibilities of owning a Bacon are not insignificant:

The fixed costs are estimated at USD 30,000, of which:

— USD 5,000 per annum in respect of an annual condition report; and

— USD 25,000 for each round trip in respect of transportation to and from a relevant museum.

Variable costs are estimated at USD 50,305.44, of which: — USD 35,305.44 per annum in respect of the insurance of the Artwork, at an insured value of USD 56,944,250; and

— USD 15,000 per annum, representing costs associated with restoration and conservation works, if circumstances so require.

Class-B shareholders (who will account for up to 99.93 per cent of the share capital) are also blocked from nominating board members and have their ownership capped at 10 per cent, above which there’s a requirement to make a takeover offer within 30 days.

What happens if a shareholder trips the 10 per cent ownership cap but lacks the ability or willingness to make an offer for the rest? Well . . .

. . . the Ownership Trustee shall initiate a Forced Sale at the best possible price on the Offered Shares, which does not guarantee the recovery of the initial value of the investment as the market price may be lower than the Offer Price. The Forced Sale process may take longer than expected, resulting in additional costs that could further reduce the amount recovered from the Forced Sale.

It adds up to fractional ownership with big provisos, in addition to all the usual provisos that come with tokenising illiquid assets. Yet a $55mn raise would be at the top of the range: appraisals cited in the memorandum put a fair market value at $45mn and between $49.5mn to $57mn. A reminder that the triptych has come to auction only once, and that Codelouf’s purchase price was $51.7mn.

Books on the placement will close on March 8. Contact Rothschild & Co Zeus Capital for more information. Or, y’know, don’t.