Despite mounting economic and geopolitical turbulence, this year’s just-released Art Basel and UBS Art Market Report delivered a cautiously optimistic message: the global art market might be recalibrating, but it’s not collapsing. While overall figures reflect a period of correction, the sector is broadening its base at the lower and mid-price tiers and drawing in a fresh wave of collectors.

Although sales across tracked geographies faced continued headwinds in 2024 due to political tensions, economic volatility and trade fragmentation—resulting in a 12 percent decline compared to the previous year, or $57.5 billion—the report shows a considerable increase in the overall number of transactions, which rose by 3 percent to 40.5 million.

The top end of the market continues to soften—sales of artworks over $10 million at auction plunged 39 percent in 2024, following a 27 percent drop the year prior—activity has surged at lower price points. Sales of works under $50,000 rose in both volume and value, with smaller galleries (under $250,000 in annual turnover) seeing a 17 percent increase. The report also confirms steady growth in the sub-$5,000 segment, which aligns with Artprice’s recent report that highlighted a shrinking number of trophy sales and a rise in transactions under $10,000.

Declines primarily reflect a thinning of the market at the very top, particularly at auctions, which could be attributed to buyers’ reluctance to sell and the growing difficulty of sourcing the kind of high-quality masterpieces that came to market more frequently in years past. As Arts Economics founder Clare McAndrew noted in the report’s introduction, art collectors are increasingly inclined to hold onto high-value works, while activity has shifted toward more liquid, accessible pieces.

At the same time, the uptick in lower-tier transactions highlights a promising dynamism driven by new buyers looking for more accessible opportunities to participate in the market. Notably, dealers reported that 44 percent of buyers were new to their businesses in 2024, which signals a promising expansion of the audience supporting the industry.

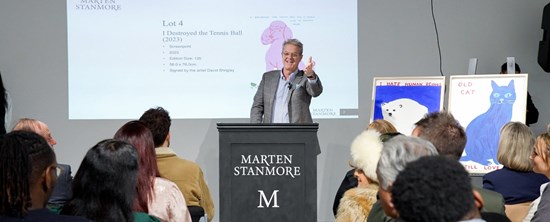

“While the market has declined in value for two years, one of the most positive developments has been the growth of sales at the lower and more affordable prices,” McAndrew said at a live panel discussion in New York this morning (April 8). “The number of artworks sold for prices in the sub-$50,000 range has expanded, and there has been evidence of success by both dealers and auction houses in reaching new buyers, giving the market a broader and more diversified base for sales. Expanding the market to wider audiences, including through the relatively unencumbered exchange of art across borders, will remain essential to its long-run growth.”

Though written before President Trump’s latest tariffs were enacted, the report anticipated mounting challenges in a fast-shifting global landscape, specifically citing the threat of anti-trade policies and protectionism. The most important advice that the report offers professionals is to look for fresh opportunities that are emerging as art increasingly merges with luxury and entertainment and a younger, affluent collector base is establishing itself at these intersections.

Art Basel CEO Noah Horowitz pointed out during the presentation that there are a lot of new people coming into the market: new buyers made up 38 percent of total sales; among the smallest dealers, that figure hit 50 percent. Even high-end dealers (over $10 million in turnover) reported that 40 percent of their 2024 sales came from new clients. At the same time, the collectors who really drove the market for the last 20 to 30 years are not buying at the same level as in the past. “There are a lot of new buyers, many from different backgrounds and socioeconomic profiles from the past, that are coming in and experimenting with buying,” Horowitz said. “It’s important to find ways to make them not just clients for today, but clients in the future.”

SEE ALSO: As Trump’s Tariffs Spark Global Trade Panic, Art Remains an Exception—at Least for Now

Interestingly, in the quest for new buyers and market opportunities, the internet is playing a smaller role than some predicted, and offering inventory online is less important than providing thoughtfully curated and highly personal online experiences. According to the report, online art sales dropped 11 percent in 2024, hitting a four-year low (though still 76 percent above pre-pandemic levels). The strongest gains in this area came through dealers’ own websites, which have doubled their market share since 2019—something that underscores the continued importance of Instagram and social media as essential tools for collectors to research, engage with and buy art at all levels. The October report published by Art Basel and UBS on HNWI collectors’ behaviors found that 43 percent had bought on Instagram without an in-person viewing. Horowitz posited that these trends and changes in buyers’ behaviors and in the industry’s landscape reflect “the urgency of expanding networks and dedicated audience engagement strategies across the spectrum in order to adapt and thrive within today’s business environment.”

As the top end of the market cooled, auctions lost ground in 2024, accounting for just 41 percent of global art sales—a 4 percent drop from 2023. Dealers and galleries, by contrast, captured 59 percent of the market in both online and offline sales across the primary and secondary markets. We know that in periods of heightened volatility, collectors tend to favor the discretion and lower risk of private sales, which could be what’s happening here. Based on public auction house data alone, private transactions have risen 14 percent year-over-year since the pandemic.

Despite criticism citing rising participation and logistics costs and questions of environmental sustainability, art fairs remained an important tool leveraged by galleries to connect with new buyers and drive sales. According to the report, 31 percent of dealers surveyed consider fairs as their primary source of leads, followed by in-person gallery walk-ins (23 percent) and client referrals (16 percent). Notably, the share of art fair sales also increased year-over-year, comprising 31 percent of total sales for the average gallery over the year, up by 2 percent in 2023, although lower than in 2022 (when it was 35 percent). Dealers active at different price tiers confirmed that most of their fair sales were concluded at the event, accounting for 70 percent, with 14 percent before the fair and 16 percent after. Overall, the report confirmed how in-person interactions are still important and the main channel of sales, both at fairs and in galleries, especially when it comes to new buyers.

A global picture of uncertain dominance

In today’s world, where power dynamics between countries are shifting rapidly, one of the most interesting parts of the report was the data on where most art trade is concentrated and how this might change. We are “at the doorstep of a new economic world regime of trade,” Ulrike Hoffmann-Burchardi, CIO for Global Equities at the UBS Chief Investment Office, said. Yet despite the increasing globalization of the market over the past years and the rise of new regional markets and hubs, sales by value in 2024 were primarily concentrated in the three largest markets: the U.S., the U.K. and China, which accounted for a combined share of 76 percent in 2024.

As of last year, the U.S. retained its dominant position in the global art trade, accounting for 43 percent of sales by value (up 1 percent). The report underscores that the U.S. market has seen the strongest recovery since the pandemic and ranks among the best-performing over the past two decades, with sales values rising 61 percent since 2005. After a 34 percent surge in 2021 and an additional 8 percent increase in 2022, the U.S. market hit a record $30.2 billion, marking its best year on record. However, that peak was largely fueled by top-tier masterpieces and blockbuster collections—a segment that began to thin in 2023 and narrowed further in 2024, pushing total sales down 9 percent to $24.8 billion.

As Tim Schneider, founder of The Gray Market, pointed out in today’s presentation, spending so much time looking backward means we’re not looking forward. The uncertainty triggered by President Trump’s renewed anti-trade policies could seriously undermine the U.S.’s supremacy in the art market heading into the next cycle, irrespective of previous trends. In 2024, France, the U.K. and Germany accounted for 56 percent of U.S. art imports and 41 percent of its exports. Imports of Chinese art and antiques remain negligible—just 1 percent of total value—but China remains the fourth-largest export destination for U.S. art, accounting for 13 percent of outbound sales. Notably, following President Trump’s “Liberation Day” tariff announcement, China speedily retaliated with a 34 percent import tax on U.S. artworks, effective April 10. On April 7, the President responded by threatening an additional 50 percent tariff on Chinese imports if Beijing does not reverse course.

Meanwhile, China—including both the Mainland and Hong Kong—held onto its position as the world’s third-largest art market, accounting for 15 percent of global sales in 2024, despite a steep year-over-year decline. After a brief post-reopening rebound in 2023 that pushed sales up 9 percent to $12.2 billion, the market contracted sharply in 2024: sales dropped 31 percent to $8.4 billion, the lowest level since 2009. The downturn reflects a combination of sluggish economic growth, more cautious buyer behavior and the ongoing property crisis—all of which have dampened collecting activity. These figures mirror similar declines across other luxury sectors. Still, Horowitz noted signs of renewed energy on the ground in Asia. Based on what he witnessed in Hong Kong, both the Mainland and regional markets seemed to be starting 2025 with renewed momentum. “There was a lot more buzz and confidence on the ground in Asia,” he said, “with significantly higher attendance from mainland China, Southeast Asia, and across the region. We had 91,000 attendees—nearly 10,000 more than last year. Everyone from Asia was there.”

At the same time, Hoffmann-Burchardi suggested that the decline of China’s art market should be viewed not as a collapse but as evidence of maturation—stabilization after a meteoric and unsustainable rise and a shift away from speculative behavior. This perspective aligns with observations Eric Landolt, Global Co-Head of UBS Family Advisory, Art & Collecting, shared with Observer during Art Basel Hong Kong. Many of the Asian clients he met, he said, were already seasoned collectors with top-tier blue-chip works. They’re highly informed, diligent and conduct thorough research. Even younger buyers are arriving well-prepared and increasingly focused on making deliberate, strategic acquisitions. “We’re having a lot of conversations about their vision and strategy for their collections,” he said, “including how to make them more publicly accessible—whether that means founding a private museum or residency or supporting an existing institution through loans and donations.”

Looking back to Europe, despite ongoing speculation about a post-Brexit slump, the U.K. retained its position as the world’s second-largest art market in 2024, accounting for 18 percent of global sales with a total of $10.4 billion. Still, its performance was only marginally stronger than China’s, as the British market recorded a 5 percent year-over-year decline. As the report notes, the U.K.—like the U.S.—relies heavily on the sale of high-value works, and as this segment thinned through 2023, total sales fell 15 percent below their pre-pandemic level in 2019 and sit just 5 percent above the Brexit low of 2020.

Meanwhile, France, which initially benefited from Brexit and rode the post-pandemic rise of Paris as a global art hub—with a dramatic 60 percent growth in 2022—began to reverse course in 2023. That downward trend continued in 2024. Although the French market remains the fourth-largest globally (7 percent of total sales) and the largest within the E.U., its value slipped just below its 2019 level to $4.4 billion. Other regional European markets also contracted under similar political and economic pressures: Germany declined 4 percent, Switzerland 3 percent and Italy 10 percent.

Similarly, political instability and a slowing economy have contributed to dampening South Korea’s once-surging art market, which saw a 15 percent decline in 2024. Japan, by contrast, is showing renewed momentum both in its art market and broader cultural sector, with a 2 percent year-over-year increase in sales, according to the report. This growth echoes findings from another study by Art Economics, commissioned by Japan’s Agency for Cultural Affairs and published last year, which revealed that Japan’s art market has expanded by 11 percent since 2011. With a 5 percent share of the regional market by value, Japan now holds the position of Asia’s second-largest art market, compared to China, which still has an 80 percent share.

During the report’s presentation, Horowitz highlighted a recent trip to Australia, emphasizing how the art world today is not only global but increasingly diverse, with new regions, players and positions entering the space. Notably, the report lacks specific data on regional markets like Latin America—grouped simply as “Other” (8 percent)—despite recent fairs in Mexico and Brazil driving activity at various price levels. The challenge here lies in the fact that much of this activity is concentrated around dealer-collector transactions rather than the public market, making data tracking more complex. Similarly, the report omits detailed data on the Gulf region, despite significant investment and activity from auction houses, lively fairs and new arts initiatives.

Challenges and opportunities in the contemporary art markets of the future

The main challenges dealers faced in 2024 were similar to those they faced in 2023: geopolitical instability, economic volatility and their impact on demand. Inflation and rapidly rising shipping costs were two of the biggest issues, even as sales were steady and amid a slowdown in demand. According to the report, dealer operating expenses increased by approximately 10 percent, with significant rises in shipping (15 percent), travel (11 percent) and art fair participation (16 percent), all amid global tensions. Consequently, most dealers (43 percent) reportedly struggled to maintain their profitability in 2024, while 32 percent were more profitable, and 25 percent maintained similar levels of profitability compared to 2023.

Dealers in the contemporary art segment experienced a more significant 11 percent drop in sales in 2024, compared to stable or increasing sales in the Post-War, Modern and Old Master segments. Auction houses also reported a 36 percent drop in contemporary art sales to $1.4 billion—the lowest level in six years—with works created within the last two decades falling 43 percent year-over-year to $1.1 billion, just one-third of their 2021 peak. These figures contradict the Artprice survey, which reported resilience and better performances for ultracontemporary art, particularly at auction, compared to other categories.

It’s important to view these results in light of the necessary price adjustments seen in the past year—particularly at auction, where this correction has led to far fewer “fresh paint” works in the marquee evening sales. Eventually, the reset should allow the ultracontemporary and contemporary art market to align more closely with realistic, primary market values after the hype and speculation of the pandemic period, stabilizing the category in the long term for the names that survive this “crash test.”

While the report revealed declining optimism among respondents, 33 percent of those surveyed still expected an improvement in sales (down 3 percent from last year’s survey), 47 percent expected sales to remain about the same as in 2024, and 19 percent saw them already declining. Dealers also reported that sales were increasingly concentrated around their top artists, with 56 percent of annual turnover coming from sales of the top three names on their rosters (a 3 percent increase year-over-year). This may be due to buyers focusing on safer acquisitions involving more stable and established names, especially at higher price tiers. However, this doesn’t hold in the primary market, where diversification is more prominent, with the share of the single highest-selling artist hitting 34 percent in 2024 (down 2 percent).

As the art world continues to address the gender gap in institutional and commercial spheres, the representation of women artists in galleries has steadily increased, rising by 1 percent to 41 percent in 2024. The most notable gains occurred in galleries focused on the primary market, where representation of women jumped from 42 percent in 2022 to 46 percent. Importantly, the report shows a correlation between this shift and stronger overall sales performance: galleries with more than 50 percent women artist representation reported a 4 percent increase in sales, while those with less than 50 percent saw a 4 percent decline. These findings align with the aforementioned Art Basel and UBS HNWI collectors survey, which showed a positive increase in the representation of women artists’ works in collections, rising from 33 percent in 2018 to 44 percent in 2024. Hoffmann-Burchardi suggested that this trend is partially due to women taking more charge in collecting, with a tendency to purchase more works by women artists, besides also being more research-focused and taking more time in their investment decisions.

Ultimately, the ninth edition of the Art Basel and UBS Art Market Report confirms that the art market is undergoing significant adjustments, likely heading toward a pivotal moment amid the great wealth transfer and global economic shifts. The hope is that the market’s broadening base—fueled by younger buyers, a focus on women artists, the rise of new regional economies and new opportunities presented by technology—will lead to a more equitable, accessible and decentralized global trade.

However, this may come at the expense of some major art markets. As Paul Donovan, Chief Economist at UBS Global Wealth Management, put it in the report’s introduction: “Despite adjustments in global sales values, transactions remain high, with positive signs from new buyers. The market’s ability to adapt and attract these buyers highlights its enduring appeal. Economic change can be daunting, but it also presents new opportunities.”

The question, then, is how quickly and effectively the industry can respond to these ongoing transformations driven by a complex mix of new demographics, wealth shifts, trade disruptions and evolving power centers in the U.S., U.K., China and beyond.