Preqin helps investors make investment decisions in everything from art to real estate and infrastructure to startups.

Depending on your investing plan and needs, you can use the Preqin platform to:

- Learn more about investing in asset classes like debt, real estate, infrastructure, and natural resources

- Connect with 250,000 alternative investment experts including consultants and hedge fund managers

- Receive quarterly updates and annual reports about company valuation changes and funds to watch

- Develop benchmarks to track your investments‘ success

All of Preqin’s features are focused on private market assets—so if you’re interested in honing your investments in public companies, you’ll need to look elsewhere.

And if you do plan to invest in private, alternative assets, Preqin isn’t your only option. Check out these seven Preqin competitors that might better suit your needs.

1. Yieldstreet

Yieldstreet is a private market, alternative investment platform that allows users to research and invest in assets such as:

- Art

- Real estate

- Private credit

- Transportation

While Preqin can connect you with investment advisors and fund managers, Yieldstreet lets you select investments and manage your own portfolio. They even offer an FDIC-insured account through which you can receive payouts.

Yieldstreet says their platform boasts a net annualized return rate of 9.7%, and that the average investor makes 8 investments through the platform.

This makes Yieldstreet an attractive option for anyone who’s interested in managing their own portfolio—but still wants some guidance and advice on potential investments.

If you decide to invest with Yieldstreet, they’ll assess a fee on your transactions.

Preqin vs. Yieldstreet: At a Glance

| Preqin | Yieldstreet | |

| Useful for | Experienced private investors | Individual investors |

| Focused on | Alternative assets | Alternative assets |

| Good for research? | Yes | Yes |

| Supports investing? | No | Yes |

| Unique feature | Make connections with fund managers | Invest directly in alternative funds |

| Cost | Limited free access; custom quoting and demo process | Fees assessed on transactions |

2. Exploding Topics

Exploding Topics is a trend spotting tool that helps investors forecast which products, industries, and companies have high growth potential.

[ss of https://explodingtopics.com/pro/ai-trending-startups]

There are a few different ways that investors can use the platform when researching their next investment:

- Browse fast-growing trends in different industries

- See currently trending startups

- View lists of trending products

Our trending startups feature is particularly useful for investors and VCs, as it allows you to sort companies by:

- Industry category

- Total funding

- Funding stage

- Date founded

- Number of employees

- Location

You can also see whether the company is experiencing regular, peaked, or exploding levels of interest.

Take Knix as an example. We first identified this popular women’s underwear brand in March 2021.

[ss of ET Pro https://explodingtopics.com/topic/knix]

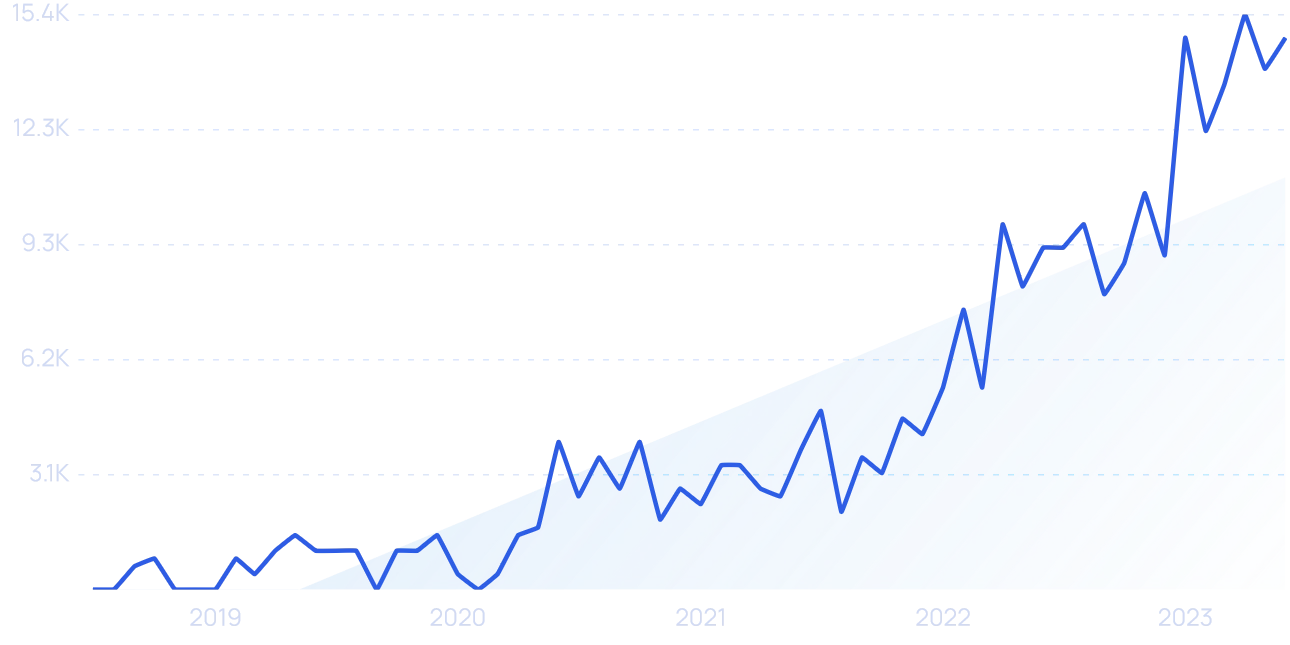

This means that investors using our platform were well aware of Knix before it surged in popularity among online searchers in early 2022, as indicated by this graph from Semrush:

We’re able to spot companies with high growth potential so early thanks to a blend of AI and human data analysis. Our system allows us to update our trend database every day, so you’re always getting a fresh look at what’s popular right now.

Preqin vs. Exploding Topics: At a Glance

| Preqin | Exploding Topics | |

| Useful for | Experienced private investors | Investors interested in startup funding |

| Focused on | Alternative assets | Private market business investments |

| Supports research? | Yes | Yes |

| Supports investing? | No | No |

| Unique feature | Make connections with fund managers | Early detection of startups with high growth potential |

| Cost | Limited free access; custom quoting and demo process | Starts at $39 per month, billed annually |

3. Masterworks

Masterworks is a fractional art investment platform.

[ss]

Over 700,000 Masterworks members use the service to invest in a variety of blue-chip contemporary art pieces, as opposed to buying a single piece themselves.

Masterworks actually purchases the art and holds on to it for up to 10 years before selling it to a private collector. During this time, individual Masterworks investors can purchase and sell shares of artworks on the platform’s trading market. If you’re holding shares of the artwork at the time it sells, you receive a portion of the proceeds.

While Masterworks is a platform designed for buying and selling shares in alternative assets, they provide art-related investment resources, including:

- Artist profiles

- Prior sales of an artist’s work

- Purchase and sale prices of other related artworks

- Gross appreciation of artworks’ value over time

There is no monthly subscription cost associated with using Masterworks as an alternative investment platform. The company makes its money by taking a cut each time they sell a piece of art.

Preqin vs. Masterworks: At a Glance

| Preqin | Masterworks | |

| Useful for | Experienced private investors | Individual investors |

| Focused on | Alternative assets | Art |

| Supports research? | Yes | Yes |

| Supports investing? | No | Yes |

| Unique feature | Make connections with fund managers | Primary and secondary market activity |

| Cost | Limited free access; custom quoting and demo process | Fees assessed on transactions |

4. Forge Global

Forge Global is a platform that facilitates buying and trading private-market assets.

There are two parts to the service:

- Forge Data, where investors can conduct due diligence on private companies, see up-to-date valuations, and develop a plan for their portfolios

- Forge Markets, where investors can actively trade securities that include stock options in pre-IPO companies backed by venture capital

The company also offers an API and CSV downloads for its Forge Data service, making it a useful option for investors that want to dig into metrics outside of Forge’s web application.

You can learn more about Forge’s approach to investing through free private market update reports available on their website.

If you’re interested in using Forge to invest in the private market, you can create an account to be connected with a specialist on the Forge team. And if you choose to invest, Forge will assess a fee on your transactions.

Preqin vs. Forge Global: At a Glance

| Preqin | Forge Global | |

| Useful for | Experienced private investors | New and experienced investors |

| Focused on | Alternative assets | Private companies |

| Supports research? | Yes | Yes |

| Supports investing? | No | Yes |

| Unique feature | Make connections with fund managers | Dedicated advisors |

| Cost | Limited free access; custom quoting and demo process | Fees assessed on transactions |

5. Moonfare

Moonfare is like Preqin in that it allows investors to connect with private equity fund managers—as well as a larger global community of investors interested in private assets.

However, unlike Preqin, Moonfare allows its users to trade directly on the platform. When using Moonfare, you can:

- Browse a curated selection of private funds

- Invest directly into a fund, pooling resources with other Moonfare users

- Trade assets with other Moonfare investors

- White-label the product for another institutional investor

There’s one catch: you can only use Moonfare if you qualify as an “accredited investor” in the U.S. This qualification requires a certain personal net worth, income level, or professional standing.

The platform also requires a minimum investment of $75,000 and will assess fees on transactions.

As a result, Moonfare may not be the best choice for anyone who’s just starting out with investing and growing their net worth.

Preqin vs. Moonfare: At a Glance

| Preqin | Moonfare | |

| Useful for | Experienced private investors | Accredited and institutional investors |

| Focused on | Alternative assets | Private funds |

| Supports research? | Yes | Yes |

| Supports investing? | No | Yes |

| Unique feature | Make connections with fund managers | Moonfare investor community |

| Cost | Limited free access; custom quoting and demo process | Fees assessed on transactions |

6. McKinsey Global Private Markets Review

The McKinsey Global Private Markets Review isn’t a full-fledged platform, but rather an annual report produced by the global consulting firm.

It can act as an alternative, or supplement to, Preqin’s reports or Forge Data.

The full report is available for free on McKinsey’s website and includes data points about:

- Trends in private market deal making

- Private market activity by country

- Effects of inflation

- Different types of private investing

- ESG investments

- Alternative asset performance

If you’re looking to grow your understanding of private market and alternative asset investing, these reports can be a good place to start. To learn more about specific startups and funds to invest in, though, you’ll want to pair it with access to a platform like Exploding Topics or Preqin.

Preqin vs. McKinsey: At a Glance

| Preqin | McKinsey | |

| Useful for | Experienced private investors | New and experienced private investors |

| Focused on | Alternative assets | Private and alternative market data |

| Supports research? | Yes | Yes |

| Supports investing? | No | No |

| Unique feature | Make connections with fund managers | Annual reports and related resources |

| Cost | Limited free access; custom quoting and demo process | Free |

7. S&P Capital IQ Pro

S&P Capital IQ Pro is an investment intelligence platform that includes both public and private market data.

You can use the service to explore:

- Public company financials

- Private company insights

- Industry-wide analysis

- ESG highlights

- Corporate filings

- Corporate credit ratings

- Risk scores

- Investment-related news alerts

Interestingly, you can also use S&P Capital IQ Pro to access private market details provided by Preqin and other platforms, like Crunchbase.

This makes it a nice choice for investors who are interested in private market investing, but whose portfolios are primarily made of investments in public companies.

If you’re interested in S&P Capital IQ Pro, you’ll need to get in touch with the company to set up a demo session first.

Preqin vs. S&P Capital IQ Pro: At a Glance

| Preqin | S&P Capital IQ Pro | |

| Useful for | Experienced private investors | Investors interested in public and private markets |

| Focused on | Alternative assets | Public and private funds |

| Supports research? | Yes | Yes |

| Supports investing? | No | No |

| Unique feature | Make connections with fund managers | Investment news alerts |

| Cost | Limited free access; custom quoting and demo process | Custom quoting available with a demo |

Conclusion

The right investment research tools for you will depend on how comfortable you are with investing—and the assets you’d like to sink your money into.

If you’re just starting out as an individual investor and would like some support, you might enjoy using a platform like Yieldstreet or Masterworks. You’ll be able to explore the world of private market and alternative investing in a guided way.

However, if you’re working on behalf of an investment team or are ready to invest independently in assets and companies with high growth potential, a service like Exploding Topics can keep you pointed in the right direction.

By combining our trending startup and product lists with our meta trend analysis, you’ll be positioned to spot the next big trend or company early—well before other investors.

Try it out and see how Exploding Topics Pro can support your investment research—it’s just $1 for your first two weeks of access.