Oscar Wilde may—or may not—have remarked that “when bankers get together for dinner, they discuss art. When artists get together for dinner, they discuss money.” Today, the domains of the worlds of art and finance have never before been more overlapping. I would suggest an aggiornamento of the adage: When investors get together to discuss alternative assets, they talk about art. When art investors get together, they talk about why investment in art-secured lending is the holy grail for people looking to diversify their financial portfolio.

In Reasons to Love Investing in Art-Backed Debt, I explained how portfolios of art-backed debt offer investors a truly uncorrelated asset class, with attractive yields and solid principal protection, without the costs associated with owning physical art or concerns of whether the art will appreciate in value over time. Let’s take a deeper dive into the fundamentals of art-debt investing, focusing on the types of questions that investors should be asking as they consider these investments as a way to earn passive income.

Americans love to leverage their assets and use financing for virtually every major acquisition. This was not always the case. Seventy years ago, only five percent of consumers financed the acquisitions of their cars. In the 1970s, auto financing became a major industry and today, virtually no one buys without financing and it is possible to borrow nearly 100 percent of the purchase price.

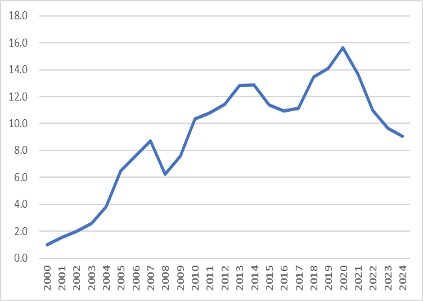

In the last 20 years, the financing of art, particularly high-value fine art, has become more widely available. Private banks, auction houses and specialty art lenders provide different options to art owners. Over time, art financing will become mainstream. But unlike cars or real estate, the value of art is less transparent and less standardized, and there are art-specific risks such as title, authenticity and attribution, which are of critical importance because art lenders must be able to sell the artworks within a relatively abbreviated timeframe in the event of a default.

When contemplating investment in portfolios of art-backed loans, what should an investor consider?

Track record of the art lender: How long has the lender been making art loans? How much of the lender’s business is focused on art lending? How much credit has the lender extended against art? Does the lender have industry expertise? The lender must understand the underlying collateral risks and have structured the loans to mitigate those risks. How has the art lender managed through borrower defaults? Lenders should be licensed to lend in states that require licensure (like California) or the loans can be voided.

Underwriting practices of the lender: The rigor of the due diligence to which the art is subjected and the lender’s underwriting practices are paramount. Art lenders should take a robust approach to due diligence and understand the art-specific risks, among others. Because there are no title registries for art (unlike real estate or cars), the lender must have in-house expertise and deep market intelligence to evaluate the materials presented by a client. Borrowers must have clear and unencumbered ownership and title to the artwork collateral. Title is a binary risk and a bill of sale and mere possession of an artwork is not sufficient evidence of ownership. A lender should also require proof of payment and other indicia of full ownership.

The art loan collateral should be salable: Ideally, a lender will look for artworks made by artists with a long auction history. The works should have a bona fide certificate of authenticity, be in the catalogue raisonne (like a bible of the artist’s complete oeuvre) or have been sold through the artist’s primary dealer. Physical inspections of the artworks and condition evaluations should be performed by expert conservators and the condition of the artwork collateral should be good to excellent.

Valuations of the art collateral are key: How is the artwork being appraised and who is doing the valuations? Is the lender using independent third-party USPAP or AAA-certified appraisers or are they relying only on internal valuations? Is the lender using data analytics to inform all or part of their credit decisions? The more conservative the valuation metric, the greater the likelihood of full principal recovery in the event that the artwork collateral has to be sold if there is a default. Typically, art lenders say that they are lending up to 50% against an artwork (or collection of artworks) but the valuation methodology plays an important role here too. Fair market valuations (FMV) include commissions and fees that are payable on a sale, which can amount to 20% or more of the price. Marketable cash value (MCV) instead nets the transaction fees out of the valuation and is another, more conservative, way of calculating the value of loan collateral. The artworks backing the loans should also be the easiest ones to sell or the most “liquid”, with a deep market of potential buyers.

Concentration risks are mitigated by diversification: The level of diversification is important at both the individual loan level and at the portfolio level. To reduce concentration risk, the individual loans should have multiple artworks created by different artists serving as underlying collateral. Ideally, an art-debt portfolio should include multiple art loans, as that means that the risk is spread across many borrowers and many artworks. It also means that the artworks are not all from the same artist, genre, type, era, etc.

Where to invest in art-backed debt

For individuals and institutional investors seeking art-debt investment offerings, the minimums generally exceed $500,000; most are much higher. Boutique lender Shinnecock Partners, through its Art Lending Fund, advertises net yields of 7-8 percent with investment minimums of $100,000. According to Alan Snyder, Managing Partner of Shinnecock Partners, it also offers direct loan participations to institutional investors with 9.75-11 percent net yields, at a minimum investment of $1 million.

A more accessible option is Yieldstreet, a leading private market investment platform, which offers art-backed debt investments to both retail and institutional clients for minimums as low as $10,000. Investors have historically received monthly distributions of interest, yielding a net average of 10.3 percent annually and Yieldstreet’s art debt offerings are also IRA-eligible. The underlying art loans are underwritten and managed by Athena Art Finance, which lends against marketable cash valuations (MCV) and has been lending against blue-chip art since 2015.

Rebecca Fine is the Managing Director of Art Finance at Yieldstreet, a private market alternative investments platform. She has over 25 years of experience in the art market and art finance.