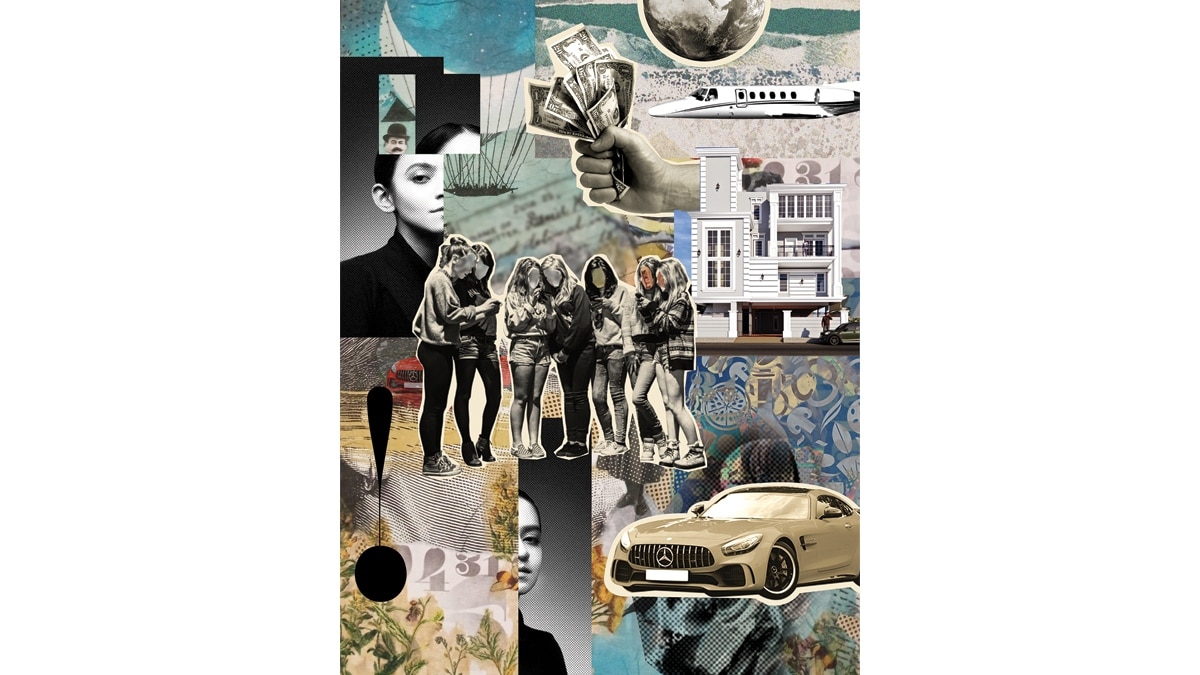

In the ever-evolving landscape of wealth management, young billionaires are forging their own, distinct path to growing their riches. They are seeking out investment opportunities in alternative avenues that encompass a range of options including real estate, start-ups and passion projects.

Not for them those conventional options of equities and fixed deposits. These individuals are diversifying their investment portfolios across a spectrum of sectors and are exploring opportunities that go beyond traditional products and even national boundaries.

Alok Saigal, President and Head of wealth management firm Nuvama Private, is seeing this change firsthand. He says young ultra-high-net-worth individuals (UHNIs)—those whose wealth is valued at over $30 million—have a very different approach to investing compared with their forebears. “They are seeking investment opportunities beyond conventional wealth management products like mutual funds, PMS (portfolio management services), bonds, and stocks. They are also keen on opportunities beyond domestic frontiers and manage currency and geographic risk efficiently—since they consider themselves global citizens,” he says.

Start-ups

One bandwagon appears to be investments in the start-up space. Young start-up founders who have turned billionaires are giving back to the ecosystem that brought them these riches, increasingly deploying their capital and expertise in other start-ups. Entrepreneurs discern the value of diversifying their portfolios. They often seek opportunities that resonate with their industry knowledge, enabling them to harness their insights and networks.

Kunal Shah, the 40-year-old Founder and CEO of fintech company Cred, is one such example. He said at a recent event that he has invested in around 80 fintech start-ups, typically committing an average of $50,000 in each. “I do not have any mutual funds or stocks; my investments are entirely focussed on start-ups as a way to give back. The primary motivation is not financial returns but rather contributing to the advancement of the ecosystem,” he said during a discussion on CNBC-TV18 at the Global Fintech Fest 2023. According to research firm Tracxn, Shah has provided early support to several fintech enterprises, including payments firm Razorpay and crypto asset app CoinSwitch.

Others, too, like the founders of Indian unicorns Zerodha, Paytm, and Zomato, have dabbled with investments in the Indian start-up ecosystem.

Typically, these investments are directed towards early-stage start-ups, often in the seed or Series A stages. “In such scenarios, investors anticipate returns ranging from 2x to as much as 10x of their initial investment within a couple of years. Co-investing with fellow founders or collaboratively establishing their funds is also a prevalent practice,” remarks Saigal.

Passion of the Rich

Increasingly, young billionaires are turning towards non-traditional “passion” investments that comprise collectible assets like fine art, vintage cars, yachts, and wine. These investments, while providing aesthetic and emotional satisfaction, also have the potential to yield impressive returns.

Art, though not a mainstream spending avenue, does interest a segment of young UHNIs.

Nikhil Kamath, the 37-year-old Co-founder of discount stock broker Zerodha and wealth management company True Beacon, believes Indian art will substantially appreciate in the years to come. He is actively researching this segment as an asset class and is particularly optimistic about the potential of acquiring works by acclaimed artists like F.N. Souza, Tyeb Mehta, or S.H. Raza, which he sees as having significant upside.

“Young billionaires enjoy art, and many of them are buying art to enjoy it, while few are looking at it as an investment avenue. But it turns out to be an excellent investment option, and the prices of works of art by Indian artists have gone up as there is a huge demand out there,” says Himanshu Kohli, Co-founder of Client Associates, a Gurugram-based private wealth management firm.

Having said that, in what is perhaps a reflection of their age and social consciousness, impact investing and strategic philanthropy have also joined the conversation. Adds Sapna Narang, Managing Partner at Capital League, a Gurugram-based all-women boutique wealth management firm, “Discussions around impact investing and strategic philanthropy are also on the rise, with some individuals discussing aligning their social and environmental goals with their investment objectives.”

Luxury Villas and more

Of course, not all traditional markers of wealth have been shunned—definitely not real estate. Consider this: Earlier this year, Neha Bagaria, the Founder and CEO of Herkey (formerly JobsForHer), 42, bought an apartment in the upscale Malabar Hill area in Mumbai for a cool Rs 121 crore.

Indeed, real estate consultancy CBRE South Asia says there has been a surge in demand for luxury homes —those that have a price tag of Rs 4 crore and above. It says luxury home sales in India have jumped a remarkable 130 per cent year-on-year in the first half of 2023 to 6,900 units from 3,000 in 2022.

“Weekend houses, big villas, farmhouses, or bigger apartments are the big preferences for these UHNIs, as they like working from anywhere. We know a lot of our clients who have bought expensive properties outside India in places like Dubai and London,” says Kohli. He says these upwardly and geographically mobile individuals shuttle between the Delhi-NCR region and Goa and Dubai.

Besides, these wealthy individuals are spreading their bets even among foreign real estate markets. Many factors underpin this trend, including the desire to provide a residence for children studying abroad and prestige. “Overseas homes are also gaining popularity, as they offer diversification and, in some cases, the prospect of acquiring citizenship or residency rights, aligning with the broader trend of global investment diversification in the real estate sector,” says Narang.

For instance, in Portugal, purchasing property priced above a certain threshold or acquiring real estate in Dubai grant individuals the chance to obtain permanent residency in those countries.

Equity markets, too, remain an attraction. “Since these founders are astute individuals, they have a strong inclination to gain exposure to direct secondary market equities. This aligns with their desire for hands-on involvement and control in the selection and management of their investments,” says Saigal. He adds that they’re also showing interest in platforms that facilitate investments in baskets of exchange-traded securities.

Clearly, the young and wealthy have realised post Covid-19 that uncertainty is unavoidable and every day is important, which is reflected in their diverse approaches to investment.

@teena_kaushal