In an ever-evolving financial landscape, investing in art has proven to be a solid strategy for many. As the art world embraces a new paradigm of digitization, the allure of tokenized art is growing for collectors and investors. So, how do you invest in tokenized art? This guide offers a step-by-step breakdown of the process, plus additional tips and information.

What is tokenized art?

Tokenized art is essentially the convergence of blockchain technology and art. It involves using digital tokens, usually non-fungible tokens (NFTs), to represent ownership of artwork. NFTs are unique cryptographic tokens that, unlike cryptocurrencies (such as bitcoin or ethereum), cannot be exchanged one for one. Because each NFT is unique, it is ideal for representing ownership of one-of-a-kind digital assets.

When artists create a piece of art (e.g., an image, animation, music, video, or any other form of digital content), they can tokenize it by linking it to an NFT on a blockchain like Ethereum. This NFT acts as a certificate of ownership and authenticity for the digital art piece. It contains metadata that specifies details about the artwork and its creator.

Smart contracts and tokenization

Smart contracts, self-executing contracts with predefined conditions, manage the ownership and transfer of NFTs. These smart contracts enable artists to receive royalties whenever their tokenized art sells or transfers to another person.

Once tokenized, someone buys, sells, or trades the NFTs on various marketplaces or art investment platforms. Ownership of the artwork is transparently verified and tracked through the blockchain, providing a decentralized and immutable record of ownership.

The difference between tokenized art and digital art is fundamental. While tokenized art represents fractional ownership of physical artworks through blockchain technology, digital art solely exists in digital formats and lacks the tangible presence of physical pieces. Conversely, traditional art differs from NFTs in that it encompasses physical creations crafted by artists.

Is investing in art profitable?

Art has been considered a valuable asset class for centuries, and people invest in it for various reasons. Art can appreciate in value over time, making it a potential investment opportunity. Some works can become more valuable as they gain recognition or popularity, and this increased demand can drive up prices.

Additionally, some investors view art as a potential hedge against inflation or as a way to preserve money in a bear market. In times of economic uncertainty or high inflation, tangible assets like art may retain or increase their value.

The art market has its own cycles of boom and bust, driven by factors such as changing tastes, market trends, and economic conditions. Savvy investors take advantage of these cycles to buy art at lower prices and sell when the market is strong.

How to invest in tokenized art

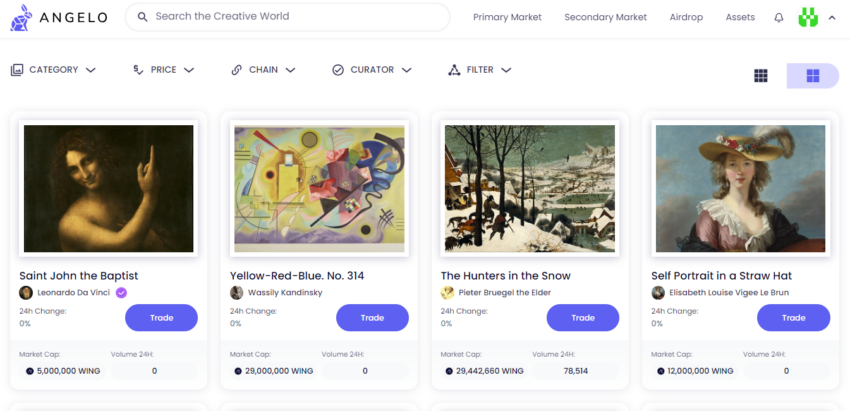

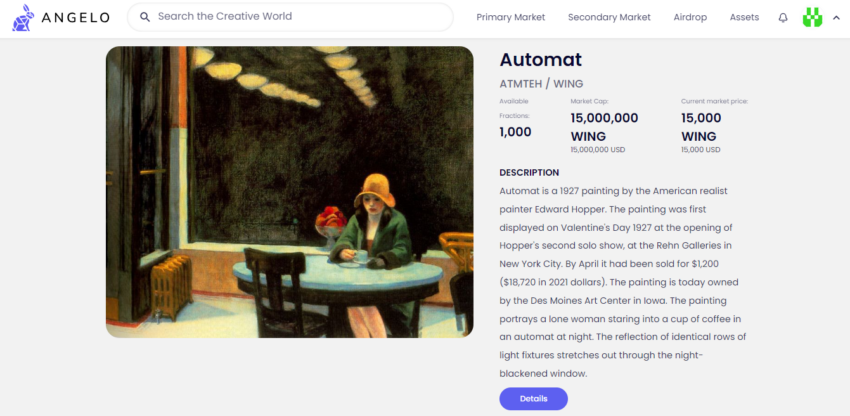

To show you how you can invest in tokenized art, we are going to use the Angelo app. Angelo is a vibrant social platform that brings artists and collectors together, enabling the purchase of modern art at an affordable price.

Users can explore a vast collection of art, directly connect with artists, and purchase unique pieces without the complexity of fractional ownership.

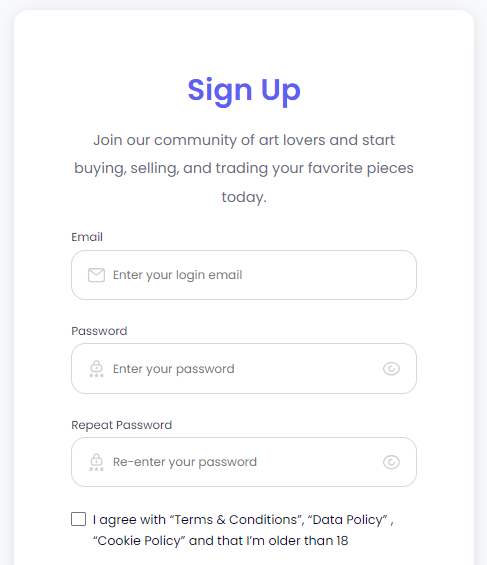

Step 1: Sign up and register for an account on Angelo. You will receive a confirmation email to confirm your account. Additionally, you will have to complete KYC processes to verify your account.

Step 2: Select an artwork. You can discover and purchase contemporary art through Angelo’s user-friendly platform.

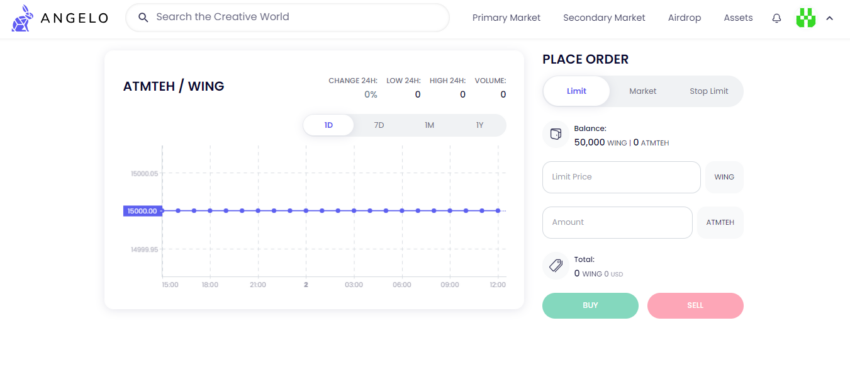

Step 3: Once you have selected an artwork, press buy. Angelo supports various order types, including limit orders, market orders, and stop losses.

Furthermore, you can make purchases with competitive fees when you use $ANGELO, the native currency of the Angelo platform. This fosters a seamless and direct connection between artists and art enthusiasts.

You can participate in the curator ecosystem to earn rewards. Acquiring $Angelo is effortless – simply sign up for airdrops and engage in active trading, or you have the option to purchase it using fiat or crypto.

Tips for investing in tokenized art

Investing in art is similar to investing in any other asset in that you must do your due diligence. Simply buying it is not enough; you must also learn how to invest in tokenized art. Here are a few tips.

1. Consult an expert

Suppose you are new to art investment or uncertain about your decisions. In that case, your first step should be to seek advice from art consultants, art advisors, or financial professionals specializing in art investments.

If you are experienced in art investment, it doesn’t hurt to consult someone who is an expert in blockchain technology, particularly NFTs. Experts understand the NFT tools needed to find high-quality works.

2. Understand the costs

In addition to the purchase price, you must remain aware of other costs involved in art investing, such as insurance, storage, and potential restoration expenses.

When you invest in a physical piece of art, you must store it in a place that preserves it. You must protect it from factors such as temperature, light, humidity, pests, air quality, and, most importantly, theft. This is similar to how jewelry is stored in safety deposit boxes.

3. Diversify your portfolio

Just like any other investment, diversification is essential with art investing. Art is subjective, so avoid putting all your resources into a single artist or art style. Instead, consider building a diversified art collection that includes pieces from various artists, periods, and mediums. The art market is volatile and subject to fluctuations based on trends, economic conditions, and changes in demand for specific artists or styles.

By diversifying your art portfolio, you spread your risk across various artworks, reducing the impact of any single artwork’s price fluctuations on your overall portfolio.

4. Use a reputable platform

Always prioritize quality and authenticity. When buying traditional art, you should always work with reputable galleries, auction houses, or art dealers who can verify the authenticity and provenance of the artwork. This caution should be replicated when using online platforms to buy tokenized art. Review reviews carefully and ensure a good reputation in investment/web3/art circles. Stay cautious of fake sites and replica links, just as you would when looking out for crypto scams.

5. Set a budget

It can be extremely alluring to ape into every tokenized art that you believe will moon. Therefore, it is important to set limits on your investing practices as a means of risk mitigation.

Determine how much you will invest in art and set a budget accordingly. Stick to your budget to avoid overspending or making emotional decisions.

Determining how much you are willing to invest in art allows you to assess your financial capacity to engage in the art market. Art collecting should not jeopardize your overall financial stability or other financial responsibilities. Art prices are sometimes unpredictable, and there is no guarantee that any particular artwork will appreciate significantly in value. A budget helps manage expectations and ensures you do not invest more than you can afford to lose.

A new dimension to art investment

When it comes to investing in art, the emergence of tokenized art has added a new dimension of opportunity for collectors and investors. By combining the tangible appeal of art with the benefits of blockchain technology, tokenized art offers unique advantages compared to traditional investment vehicles.

Investors can now diversify their portfolios with fractional ownership of high-value artworks, benefiting from potential appreciation while gaining access to the previously exclusive art market.

Frequently asked questions

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.