The stock markets have been a rollercoaster for investors so far this year, soaring in January before giving back half of their gains in February as the rally ran out of steam.

It has been a hair-raising ride and one which might lead investors to consider diversifying their portfolio and stepping into the more refined world of art.

The art market does not rise or fall with the stock market and so investments are not subject to the same fluctuations.

Art, however, often requires a significant outlay and is a non-liquid asset, meaning it cannot be quickly converted into cash.

Is art a good investment?

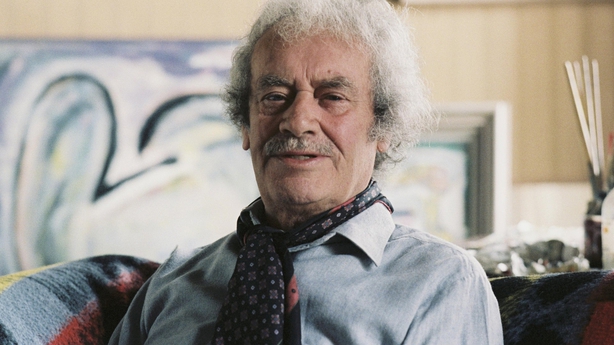

“Yes, I think so. Long term it usually is,” according to Ian Whyte, chairman of Whyte’s auction house, a family business in Dublin for over two centuries.

“There has always been a demand for art since ancient times. Most human beings would have an appreciation for art. It is something that people have collected and wanted to have in their homes.”

But art is almost always a long-term investment. It can take years, even decades, for an artwork to reach its peak value.

The art market is not the place to invest, therefore, if you are looking for a quick return.

There are other factors to consider as well.

Grit Young, Partner, Strategy and Transactions, at EY Ireland says art as an investment in its own right is a higher-risk asset class, because capital outlay for one piece of art is high, thereby reducing the opportunity to diversify.

It is also an illiquid investment relative to other options.

“For example, an investor may decide to purchase a significant work of a currently highly acclaimed artist only to see their investment dwindle rapidly due to a public incident involving the artist post-purchase,” she said.

“Art is usually associated with personal brands that carry obvious risks.”

Ms Young said art as a small percentage investment of a wider portfolio strategy, however, may be a good way to diversify a portfolio that may exist predominantly of equities, debt securities, real estate and private capital.

Not many people buy art exclusively for an investment.

“There are funds that invest in art but most of the people that we encounter at our auctions would be collectors,” Mr Whyte said, “and there would also be people who would just like something nice on their walls.”

Do you have to have an eye for art to invest?

“Not necessarily,” the chairman of Whyte’s said, “but if you are going to invest in art, I think you should like what you are going to invest in as well”.

Whyte’s advise people to look at the pictures at an exhibition and make a list of 10 that they like.

“We’ll go through them and say, that’s certainly going to go up in value over the years, or that will hold its value, that one over there is a nice decoration, if you get it at the right price, it’s fine, but it’ll probably never really go up in value,” Mr Whyte said.

He added that it is important to seek out informed advice, perhaps from a serious collector.

It also worth checking an artist’s CV, so to speak. An artist who is shown in galleries or museums, has their work included in collections or wins critical acclaim, will likely see their prices increase.

Mr Whyte said, “There are always the outsiders who come in and every so often, an artist who nobody has heard of suddenly becomes fashionable and takes off in price.”

The Irish art market

Paintings by Jack B Yeats have rocketed in price in the past 20 years.

Shouting, an epic large-scale oil on canvass by the Irish artist, made headlines when it fetched €1.74 million at auction in 2021.

Works by Gerard Dillon and Patrick Collins have sold well and works by female artists who were neglected in previous years such as Mainie Jellett, Grace Henry and May Guinness have doubled in price in the Irish art market in the last 20 years

Ian Whyte gives the example of Dublin artist Ciaran Clear who painted moonlight scenes, “that some might regard as being a little twee” that have rocketed in value 20 years after his death.

“There was an example of one that was bought for less than €1,000 4 or 5 years ago and it made €6,000 last year,” he explained.

He said artists William Scott, Sean Scully and William Crozier, have a more international reputation and are collected in America, the UK and Europe.

The work of sculptor Rowan Gillespie, probably known best for Famine on Custom House Quay, is going up in value, as is the work of Frederick McWilliam and Anthony Scott.

Is now a good time to invest in art?

Like any investment, it is good time if you time it right and take a long-term view.

Emerging artists offer a higher risk but also a higher potential return on investment, as their careers progress and they become more established their work will increase in value.

Understanding which artists are on the cusp and worth investing in should only be done with the advice of art experts.

Established artists offer a good balance of risk and potential return.

To mitigate risks, you should also make sure that art is part of a diversified portfolio and not your soul investment.

A diverse selection of artists within your collection is also recommended so that if one artist does not fare so well another may gain in value.

Since the Covid-19 pandemic a large portion of the art world has moved online such as auctions and art fairs, creating more opportunities than ever before to get involved in the market.

Art itself has also gone digital.

During 2021 and 2022 blockchain technology and the non-fungible token (NFT) phenomenon offered an opportunity to allow investors to buy small stakes in pieces of digital art.

“However, governance concerns remain and have heightened since the spectacular collapse of some crypto companies,” said Ms Young, Partner, Strategy and Transactions, at EY Ireland.

“Having said that, offering investors to invest in units of pieces of art makes perfect sense and the asset class would benefit from a well-regulated and governed platform that could act as an exchange.”

No matter what form art takes, it is very important to invest in art that you love because as a long-term investment, it will adorn your home for a long time, and you may as well enjoy it.