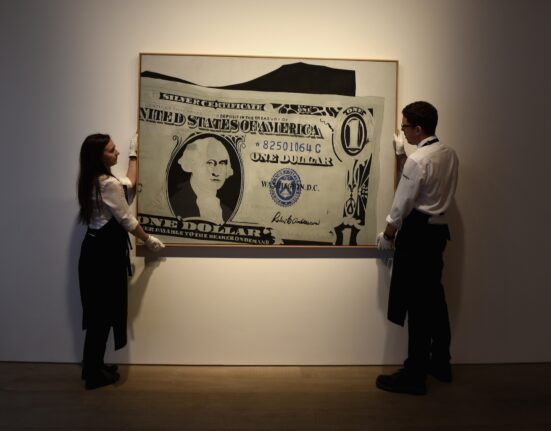

A growing number of galleries around the world are offering art as an investment, but legal bodies have been slow to act in an area that is still being played out among buyers and sellers—until now.

Last month, the public authority responsible for regulating the Italian financial markets suspended an offer by an Italian company that claims to sell paintings and then buy them back 18 months later for a guaranteed 6.8% increase in value.

In its ruling on 14 May, the Commissione Nazionale per le Società e la Borsa (Consob) notes how the company, Art Invest Srl, claims buyers can “invest safely in certified and guaranteed works”. In a video published on social media, the company states that it is possible “to purchase certified works of art for a minimum amount of €3,000”. The promotional message also specifies that “through a repurchase agreement at the end of 18 months [the customer can] choose whether to keep the purchased works or return them for the value of the amount spent increased by 6.8%”.

Crucially, the ruling notes, the structure of the transaction is presented as a “form of investment of a financial nature”, with art being treated as a financial product which was being advertised to the Italian public. This alone is not illegal, but, according to the ruling, Art Invest Srl had not registered with Consob nor had it adhered to the necessary conditions including publishing a prospectus that provides details of the investment offering to the public. Art Invest Srl could not be reached for comment and has 60 days to reply to the ruling.

Massimo Sterpi, a partner with the Italian law firm Gianni & Origoni, says companies and people often “very much underestimate the complexity of these structures”. He adds: “Just because they are art collectors, does not mean they are exempt from the rules of commerce, or the taxation of commercial activity, or financial regulation.”

Sterpi suggests entities such as Art Invest Srl are operating more like banks, but without any of the protections such as holding a certain amount of collateral, early warning signs around insolvency and compensation schemes. He says: “In general terms, setting up any new financial structure to do with art should clearly state that art is an object that has a price and is mass circulated, according to normal commercial rules.”

The advent of NFTs prompted Consob to start cracking down on investment offerings in recent years, but Sterpi also observes a “growing attention from the financial authorities to these kinds of schemes, especially when they are being put out on social media networks”.

So will the Italian ruling have an effect on jurisdictions elsewhere? The use of social media and other online tools could complicate matters here. As Sterpi points out, a gallery or entity might be based in one country but “as soon as they start to actively target an audience in, say the UK, by organising a conference or addressing emails, they are liable to answer to UK laws”.

The UK’s Financial Conduct Authority (FCA) has yet to intervene in the way Consob has. Jon Sharples, a senior associate at the Howard Kennedy law firm in London says it is surprising that there has not been the same kind of regulatory enforcement action in the UK, “particularly because there have been so many investment structures coming out of the UK in the past few years”.

One of the reasons Sharples thinks the FCA has not acted is because many of the offerings are being “advertised in a way that isn’t totally public, it’s very targeted advertising on social media depending on your specific profile”. The second thing, Sharples notes, is “there’s also the idea that this relates to wealthy people—it’s not a systemic thing that preys on ordinary people, so it’s not a priority”. However, Sharples adds: “it’s only a matter of time before someone who’s been disappointed about the promises that have been made decides to sue”.

Whatever your jurisdiction, Sterpi advises: “You should only buy art because you like it.”