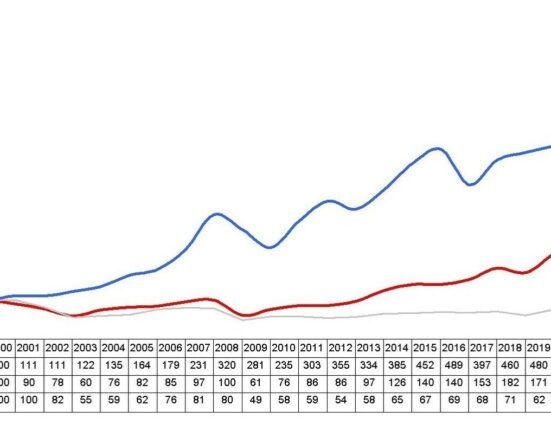

Invest in businesses rather than projects. Capital allocation is about looking at the forest and the trees, and top performers look at the forest first. The outperformers in BCG’s capital allocation database invest systematically in businesses that create value from a strategic as well as a financial point of view, whereas underperformers invest too much in value-destroying growth. (See Exhibit 2.)

While high-performing companies certainly focus on the financial return of individual investments, they also assess the strategic attractiveness of a business and the extent to which an investment is supported by favorable tailwinds from the market and strengthens the firm’s competitive advantage, which is key to producing sustainable high returns. Assessing strategic potential helps avoid common capital allocation pitfalls, such as the maturing-business trap (not reducing capex even though the business is maturing) and the egalitarian trap (every business unit gets its “fair capex share,” irrespective of potential).

A business potential-based approach to capital budgeting helped IBM, for example, reorient its portfolio from hardware to cloud-based services. Similarly, Tata Consultancy Services divested its call center operations, even though the business was still booming, to free up management capacity and resources for a push into value-added services, which the company believed to be much more promising going forward. Today, many companies in the energy and automotive industries are shifting their investments away from their past cash cows and towards renewables and green technology. Naturally, the magnitude and speed of the shift depends on the perceived size of the concrete green business potential.

Translate portfolio roles into capital allocation guidelines. Assigning clear roles to the individual businesses in the portfolio and setting corresponding capital allocation guidelines is a good way to link strategic potential to resource allocation. (See “Corporate Portfolio Management: Theory and Practice,” BCG article, April 2011.)

Take the example of one of our clients, an international energy company, which classifies business units as development, growth, anchor, or harvesting businesses, depending on their position in the market life cycle. Each portfolio role has its own performance requirements, and businesses are managed based on specific sets of financial indicators. More important, the role of each business determines its guidelines for capital allocation. For example, coal power generation is classified as a mature harvesting business and capex is limited to mandatory investments, effectively shrinking its asset base. This frees up money for investments in the renewables segment, which is considered a growth business and as such is allowed to invest up to three times its own cash flow from operations.

Balance the investment portfolio. Another way to link corporate strategy to capital allocation is to analyze a company’s investment program from a portfolio perspective. Is the investment portfolio consistent with the company’s strategic priorities, and is it balanced according to key strategic criteria?

The energy company mentioned above regularly analyzes the risk-return balance of its investment portfolio. Doing so enabled the company to see that it was focusing too much on low-risk, low-return projects and making only a few big and risky bets with a high potential return. As a result, management changed the investment strategy and encouraged managers to take on more small, but high-risk, endeavors in order to improve the company’s overall risk-return profile.

A medical devices company that undertook a similar analysis realized that it was spending too much on product life cycle management and “me too” products and was not investing sufficiently in the next generation of blockbuster devices. The company had fallen into a typical trap. It was favoring investments with short payback times because of financial attractiveness and low perceived risk, and these opportunities were crowding out higher-risk investments with longer payback times—the investments necessary to generate future growth.

Investment Project Selection

Funding individual capital projects is a financial exercise, but outperformers also make sure that they fully understand the financial profile of the projects in question—the quality of the estimates, the variability of cash flows, and the payback profile over time.

Go beyond internal rate of return. In theory, there is a simple rule for choosing among competing investment projects: sort the list of projects based on their expected internal rate of return and select those with the highest IRRs until the budget is fully committed. In practice, however, the effectiveness of this approach is constrained by the quality of the assumptions that go into the valuations and by the influence of additional criteria that are not transparent or not explicit in selection decisions.

A good way to improve the quality of assumptions is to require all business cases for major investment projects to include a model that shows the important business drivers. This makes critical assumptions explicit and allows decision-makers to understand the impact of the key drivers. Moreover, it facilitates simple sensitivity and scenario analyses. Managers can calculate the break-even values of critical variables that must be achieved for the project to generate value. This approach will help avoid focusing only on the expected rate of return in a hypothetical base case.

At many companies, criteria beyond financial returns also come into play in making investment decisions. But if such factors are not made explicit and predefined upfront, they can distort the decision-making process and encourage political behavior. One European industrial conglomerate addresses this challenge by evaluating investment projects based on four explicit criteria that are summarized in a simple scoring model: strategic profile (growth potential and fit with the strategy of the underlying business), financial profile (expected project return and short-term impact on EBIT), risk profile (payback time and assessment of market risks), and resource profile (fit with existing capabilities and required management attention).

Management still makes the final investment decision, but the decision-making model ensures that all relevant aspects of the decision are explicit and taken into account. Sustainability considerations and metrics can also be factored into the decision in this way.

Apply relevant criteria. Depending on the structure of a company’s investment portfolio, decision-makers may need to apply different sets of criteria for the different types of investment. For example, a strict focus on internal rate of return and payback time may systematically favor incremental improvement investments at the expense of larger breakthrough or growth investments that tend to have longer-term and uncertain payoffs.

The process followed at a large mining client illustrates best practice. The company applies relevant, but different, evaluation criteria for each investment type. Efficiency improvement investments, such as equipment upgrades, are assessed based on their direct financial impact. Capacity extensions, on the other hand, are evaluated in the context of market assumptions, such as competitor capacity and the outlook for commodity prices. And long-term investments, such as R&D in digital technology, are weighed on the basis of strategic attractiveness and prospective longer-term options; financial returns are not part of the analysis. Such an approach ensures that the company chooses the best projects within each investment type without discriminating against individual categories.

Embrace risk—based on true understanding. Understanding the underlying risks should be a particular focus in project selection. Research has shown time and again that human beings are weak at risk assessment, but some techniques can help. A good starting point can be to frame the discussion in terms of a base question: What do we need to believe in to make this an attractive investment? This framing can help uncover the implicit business assumptions behind a proposal and the key risks hidden in the business plan. For very uncertain investments, the critical assumptions of an investment may even be tested in systematic validation experiments through a “discovery-driven planning” approach.

Some companies use advanced modeling techniques, such as Monte Carlo simulations, to get their arms around the risks inherent in an investment proposal. While these techniques have their merits, few decision-makers want to rely on such complicated “black box” models, especially when large, important, and complex investment opportunities are at stake. In our experience, it is more important to get the relevant risks out on the table than to quantify their exact impact. A method that often helps is a “premortem analysis”—imagining that the planned investment has failed terribly, then asking everyone to find reasons for what went wrong. The focus quickly shifts from confirming that the investment has great potential to uncovering its hidden risks. The required funds should only be committed when these risks seem manageable.

Investment Governance

High performers apply the right governance mechanisms to choose, support, and track major investments. They seek to address cognitive biases, establish accountability, and institute effective feedback loops.

Address cognitive biases. Research and experience have shown that capital allocation decisions are prone to several cognitive biases, such as framing decisions too narrowly, relying too heavily on readily available information, anchoring (that is, being reluctant to adapt to new information), and falling into “groupthink” (making decisions as a group in a way that discourages individual dissent).

To sidestep such biases, we recommend applying the following practices to the design and management of the project selection process:

- Establish a central investment committee that can act as an independent warden of return-on-capital performance and a “final safeguard,” as former Rio Tinto CEO, Sam Walsh, called it.

- Bundle project investment decisions in monthly or quarterly investment committee meetings, rather than making decisions on a continuing basis. In this way, potential tradeoffs between projects—including projects in the pipeline—become more apparent.

- Push each business to propose enough projects to allow for tradeoffs and selection—for example, by applying systematic investment-search and idea-generation approaches.

- Ensure that each investment proposal contains a next-best alternative. Too many proposals are presented in such a way that management can make only a go or no-go decision. This particularly applies to projects that are “legally required.”

- Foster a culture of “constructive disagreement” by assigning proponent and skeptic roles in cross-functional teams to help prevent confirmation bias.

Establish accountability. In most firms, incentives are tied to company or business unit performance. The consequences of large investment decisions typically take too long to materialize to have an impact on an executive’s bonus or promotion. This can lead to moral hazard, especially when managers expect to move on after a couple of years in a position.

We recommend tying personal targets and incentives to the success of major investment projects through the establishment of long-term compensation components and accountability. A global chemicals company, for example, has established a manager evaluation system and a long-term bonus pool that assigns a big part of the responsibility for success (and rewards) to the initiator of an investment proposal. External factors are not accepted as excuses for failure; teams are expected to account for them when a project is proposed in the first place. Executives are incentivized to apply scrutiny when they propose a major investment—and also to ensure its ongoing success even after they have moved on.

Institute feedback loops. In the end, successful capital allocation is the result of strong judgment skills, which are built through learning and adaptation. Effective feedback loops are essential. In M&A, which often requires a very large allocation of capital, this type of rigor and commitment to continued learning is one of the reasons that frequent dealmakers consistently outperform less experienced companies. (See BCG’s M&A report series.)

While post-completion audits for large projects are common in many companies, the feedback into decision-making typically happens only sporadically. Advanced companies review not only projects but also past decisions. The head of corporate strategy at a large industrial conglomerate puts it this way: “We made our biggest losses from moves not made. So, we also explicitly review opportunity cost mistakes.”

The systematic review process at Bridgewater, a large investment management firm, includes a root cause analysis of the specific data, decision criteria, and steps involved in the original investment decision. The investment committee also explores the thoughts of everyone involved at the time of the decision to enable personal growth and skill building.

Capital is only one scarce corporate resource requiring careful allocation. Executive time and management talent, IT capacity, and operating budgets are others. But capital often has the biggest impact, which is easy to measure. The three basic disciplines of capital allocation—strategic budgeting, project selection, and investment governance—provide a powerful framework, and the best practices within each discipline give any company a good set of guidelines to follow. (See Exhibit 3.) These days, investors are quick to punish what they regard as wastefulness. They are equally eager to reward smart capital allocation decisions and strong execution.