“Feel free to stop by,” she responded.

“I’ll be there in five minutes,” Philbrick replied.

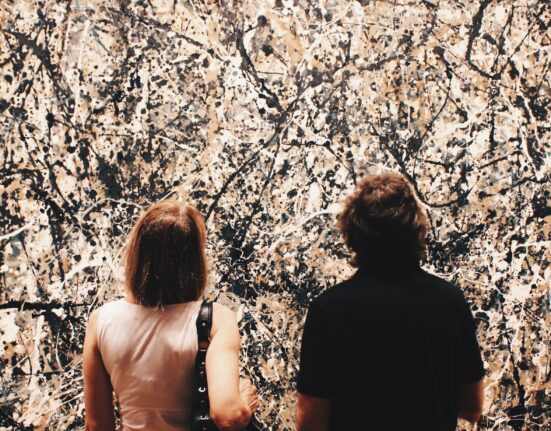

At the time, Philbrick’s businesses were hauling in revenues of approximately $100 million annually. Later that night, showing her his gallery, he leaned over and kissed her. Baker-Harber was entranced. “He could hold an entire room in awe just by discussing the context of an artist’s work or what it represented,” she says.

“From that point forward, we were together nonstop.”

Fast-forward to May 2019: They’d been a couple for nearly two years with no talk of permanence. Philbrick had never told her about his business problems, which were multiplying. And while she never understood “the intricacies of art world finance,” she says, “I merely saw buying and selling and ‘flipping’ as something tantamount to commodity or stock trading.” On a walk through Hyde Park, he gave her a glimpse behind the curtain: “I laid out my relationship with Jay Jopling and his financing of my business, as well as the fact that I may have done illegal things in trying to resolve my untenable situation with jointly owned artworks between multiple parties. She probably didn’t believe me…. The whole world knew me as this wunderkind art dealer…. How could it be otherwise?”

Of course, at this point, Philbrick believed that he could salvage his sinking business—a faith he clings to even writing from prison years later. If prices had risen, he says, everyone would have been paid. It had worked before. “The aim was always to pay everyone out, and with a profit—something I managed many times despite the over 100% percentages sold,” he says.

“By no means am I blameless, but the people I was partnered with were all seeking an edge,” he says.

“Until the very last moment, I’d been squaring off debts, paying out profits, and closing accounts,” Philbrick says.

I wanted to believe him. From prison, thousands of miles away, he had done to me what he had done to his investors: seduced me, sold me, convinced me of his at least partial innocence.

Then I spoke with the FBI.

EPISODE 4: THE LAW

The FBI Art Crime Team are the high sheriffs of the art market. The Philbrick case, with at least two dozen alleged victims across the world, was an insanely complicated puzzle that took months to understand, much less solve, according to special agents Christopher McKeogh and Jessica Dittmer. Foremost among the injured parties was the art investment firm Fine Art Partners. From their base in Berlin, the principals in the firm traveled to London, where Philbrick proved his prowess with a dazzling first sale: a work by the visual artist Danh Vo in 2014, which he resold at a respectable profit before they’d even sent “our share of the purchase price,” a FAP principal would write in his victim-impact statement. After Philbrick’s downfall, the principal would say he learned the resale never happened: Philbrick had paid their “alleged profit share” out of other funds.

“We took the bait,” he wrote. Between 2014 and 2019, FAP invested $17.8 million with Philbrick. In February 2016, prosecutors say, they agreed to purchase Rudolf Stingel’s Untitled/Picasso through Philbrick for $7.1 million. Three heat-generating years later, Philbrick told FAP that he had consigned the Stingel on their behalf to Christie’s, which had “guaranteed” a price of $9 million, meaning if the auction price was less, Christie’s would buy it for the agreed amount.

Meanwhile, in June 2017, Philbrick had done a separate deal involving the same Stingel and two other paintings with Simon and David Reuben, two of the richest people in the UK. Represented by Simon’s daughter, art consultant Lisa Reuben, their company, Guzzini Properties, paid $6 million for the paintings.

In all, prosecutors say, Philbrick sold interests in the Stingel to three different parties, who gave him more than $15 million in total. (Philbrick says he received less than $10 million total.)

When the Stingel sold in May 2019 for a disappointing $5.5 million, its listed consigner was Guzzini. That was news to Fine Art Partners, who began investigating. They eventually discovered that Philbrick was not in possession of the work, and that the Christie’s contract Philbrick had sent them was forged.

Pesko, on whose yacht Philbrick and Baker-Harber met, turned out to be another victim. In August 2016, according to a witness statement filed by Pesko, Philbrick propositioned him with Basquiat’s stellar 1982 painting Humidity—featuring a red-nosed figure who resembles Andy Warhol with his arms outstretched to the heavens. If they moved fast, Pesko said Philbrick promised, they could scoop it up at a 30 percent discount. Philbrick said Christie’s would guarantee it for $35 million, which enticed Pesko’s father’s company Satfinance to invest $12.2 million for 50 percent of the painting. Philbrick retained the other 50 percent, along with a $3 million loan from Satfinance secured by the painting. Philbrick produced a sales slip that showed he would be paying $18.4 million for the work from an entity called SKH Management Corp, according to Pesko, and later took him to see it in a Long Island storage facility.

There was just one problem: SKH never owned the Basquiat, which had already been purchased by Philbrick from Phillips auction house for only $12.5 million. Two months later, according to prosecutors, Philbrick sold another 12.5 percent of Humidity to Delahunty Fine Art, telling the gallerist Damian Delahunty he had purchased the painting from SKH for $22 million, omitting that he had sold an interest in the painting, and transferred its title, to Satfinance.

The Christie’s auction “did not materialise,” Pesko would state, so the alleged guarantee never arrived. Not to worry, Philbrick told Pesko: He had several interested buyers, including the fashion designer Tory Burch and a Saudi royal, according to Pesko’s statement. (A representative for Burch says she knows nothing about this.) Philbrick had also pledged the oversold and overleveraged Basquiat to a collateral pool for a $10 million loan from Athena Art Finance, a New York–based lender that secures loans with “blue chip” art.

“Athena, Satfinance, and Delahunty are currently locked in litigation over ownership of the Basquiat,” according to the US government’s sentencing memo in Philbrick’s case.

Some of the two dozen victims the FBI identifies as being caught up in the scheme must have been left feeling as if they were trapped inside a Cubist painting, their prize purchases carved up and resold in myriad ways. “In some instances Philbrick purported to sell works owned by others without their knowledge or consent,” says someone familiar with the case. “In other cases, he purported to pledge as collateral on loans to his own business works owned by others without their permission, as he did with works by Basquiat, Stingel, Donald Judd, and Christopher Wool.”

Philbrick’s dealings also ensnared his former mentor, Jay Jopling. By 2017, frustrated over unsold art he and Philbrick owned together, Jopling demanded an explanation. According to Newland, Philbrick told Jopling that a “client” was delaying payment for a $4.5 million sale. Philbrick then invented one from whole cloth, an Argentine financier named Martin Herrero, with a fake email address, correspondence, and payment plan to match.

By December 2018, Philbrick was reportedly $20 million in debt and “spinning plates,” in the words of the FBI’s McKeogh.

“His accounts to me were more erratic and inconsistent,” Pesko said in his witness statement. “He was very nervous at a lunch we had together in London on 30 September 2019. He had two glasses of wine and was visibly shaking.” Another client recalls a major red flag: “You could see it in his Instagram pictures,” he says. “His eyes were hollow and dark, it wasn’t the same bright-looking vivacious Inigo.”