To further improve the Sustainable Finance Disclosure Regulation (SFDR), Triodos Investment Management (IM) proposes a simple, clear and comparable categorisation system that informs all investors about the sustainability efforts of a financial product. The key principles of the proposal are that all products should be comparable, that the comparison should be easily understood, that it contributes to the original objectives of the SFDR, and that the categorisation can stand the test of time.

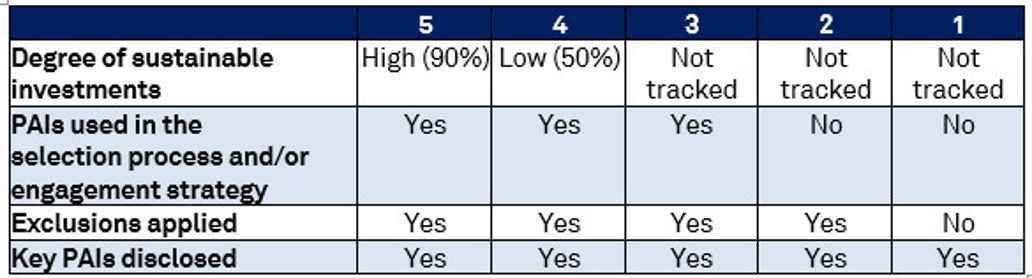

Triodos IM’s proposal includes categories that distinguish to what extent a financial product considers sustainability, based on their disclosure of:

- the degree of sustainable investments in the product according to the Taxonomy Regulation and/or following art 2(17) of the SFDR1,

- if the Principle Adverse Impact Indicators (PAIs) are used in the investment process and/or the engagement strategy, and

- whether exclusions are applied or notwith as a minimum the required exclusions of the Paris Aligned Benchmark2. This would imply 5 categories, from “strong” to “no explicit” consideration of sustainability in a product. Each financial product should be categorised following this system and should disclose the category in the pre-contractual documentation of the product.

The table below shows what such a categorisation system could look like.

On top of the categorisation, Triodos IM argues that all financial products should disclose a set of key PAIs that allow investors to compare the adverse impact, regardless of the categorisation of the product. As a result, sector-based benchmarks on performance can be established to increase comparability. Since only existing disclosure requirements that are already available are being used, this would be cost-effective for market participants to implement.

With this proposal for a simple and comprehensive system of categories that encompass the full spectrum of financial products, Triodos IM aims to contribute to the SFDR revision that was initiated by the European Commission with their Consultation. The proposed system would enable investors, especially retail investors and their advisers, to compare all available products based on the same set of basic sustainability information and help steer investor’s choices as intended with the SFDR.

About Triodos Investment Management

Triodos Investment Management connects a broad range of investors who want to make their money work for lasting, positive change with innovative entrepreneurs and sustainable businesses doing just that. In doing so, we serve as a catalyst in sectors that are key in the transition to a world that is fairer, more sustainable, and humane.

We have built up in-depth knowledge throughout our 25 years of impact investing in sectors such as Energy & Climate, Inclusive Finance and Sustainable Food & Agriculture. We also invest in listed companies that materially contribute to the transition toward a sustainable society. Assets under management as per ultimo June 2023: EUR 5.7 billion.

Triodos Investment Management is a globally active impact investor and a wholly owned subsidiary of Triodos Bank NV.

1. The percentage should be calculated based on the current value of all investments, excluding cash.

2. The exclusion list of the Paris Aligned Benchmark consists of the involvement with controversial weapons and tobacco, violation with the UN GP Principles or OECD Guidelines for Multinational Enterprises, and thresholds for coal, lignite, oil and gaseous fuels and GHG intensity.