What Is a Collectible?

A collectible refers to an item worth far more than it was initially sold for because of its rarity and/or popularity.

The price for a particular collectible usually depends on how many of the same items are available and its overall condition.

Common categories of collectibles include antiques, toys, coins, comic books, and stamps. People who amass collectibles take a lot of time to collect them and usually store them in locations where they will not be ruined.

Key Takeaways

- A collectible is an item worth far more than it was originally sold for because of its rarity and popularity, as well as its condition.

- Collectibles aren’t always as common or as great an investment.

- The term collectible is sometimes applied to new items that have been mass-produced and are currently for sale.

- The advantages of investing in collectibles are that it’s a fun hobby with appreciation potential, items can be passed down to future generations, and it can provide some diversification benefits.

- The disadvantages of investing in collectibles include highly volatile values, a lack of income generation, lack of liquidity, high transaction fees and costs, and the risk of owning counterfeits.

Understanding Collectibles

As mentioned above, collectibles are items that usually fetch more money than they were originally worth. Many collectibles can go for a pretty penny if they’re rare. The condition of a collectible also has a great deal to do with its price. Having a collectible in pristine condition means the price can go up. But if an item has deteriorated over time, there’s probably a good chance it won’t be worth much—if anything at all.

Collectibles aren’t as common or as great an investment as marketers would have you believe. If the product is still in production, the company eventually sees the market signal and produces more to supply the market.

The store of value that makes a collectible usually doesn’t come into play for many years, and it never comes at all for the vast majority of items. As the number of a particular product dwindles through attrition after its production run is over, some items become collectible due to their relative scarcity.

The term collectible is sometimes applied to new items that have been mass-produced and are currently for sale. This is a marketing gimmick used to stoke consumer demand. Items currently for sale may run into supply issues that drive up the price asked for by resellers, but this is a different phenomenon from what drives the value of true collectibles.

Insurance for Collectibles

For those who own collectibles, it may be wise to purchase collectibles insurance. These insurance policies protect your collection from accidental breakage, theft, flood, and other types of loss. While such protection is critical for priceless items, your collection does not need to be worth millions to be worth insuring.

Several insurance providers offer add-on collectibles coverage to existing homeowners’ policies. Generally speaking, collectibles insurance is relatively inexpensive, but naturally, the cost varies depending on the value of your collection.

Collectibles vs. Antiques

People often use the terms collectible and antique interchangeably. But it’s important to note that there is a distinct difference between the two. While all antiques may be collectibles, not all are antiques because collectibles don’t necessarily have to be old to be worth money.

An antique is something people collect because of its age. Antiques may include furniture, art, knick-knacks, jewelry, and other objects.

Some antiques can be worth a lot of money. Rare and authentic antiques in high demand may come at a high cost. But other antiques may not be worth much—other than sentimental value. For example, a piece of furniture passed down within a family, from generation to generation, might be valuable for emotional reasons and not for money.

Advantages and Disadvantages of Investing in Collectibles

The biggest benefit of investing in collectibles is purchasing items that excite you.

Whether it’s sports memorabilia, antiques, comic books, fine art, or model trains, people generally get into specific collectibles as a hobby they’re passionate about versus to make money.

That said, adding collectibles as an asset class might make sense for investors looking for further diversification. And while you shouldn’t expect it, collectibles have appreciation potential.

On the other hand, investing in collectibles is fraught with risk. With collectibles, beauty is in the eye of the beholder as they don’t generate any dividend income, so specific markets can crash just as quickly as they can rise.

Lack of liquidity is also a concern with collectibles, as are high transaction fees, handling, and storage costs. Finally, counterfeiting is a significant problem in any collectible niche

-

Allows you to collect things that you’re passionate about

-

Items can be passed down to future generations

-

Some diversification benefits

-

Appreciation potential

-

Collectibles are notoriously volatile

-

Collectibles are not income-generating assets

-

Lack of liquidity

-

High transaction fees, handling, and storage costs

-

Buying counterfeits is always a possibility

Examples of Collectibles

There are genuine collectibles that have become extremely valuable, namely trading cards and stamps. The most valuable collectibles in the world include the T206 Honus Wagner baseball card issued by the American Tobacco Company in 1909. Honus Wagner cards almost always sell for over $1 million if they are in good condition. In May 2021, the card sold for a new record of $3.7 million. That is an impressive haul for a card that was stuffed in cigarette packs as a free gift.

Another example is the Treskilling Yellow. This is a misprinted Swedish postage stamp that sold for somewhere around $2.3 million in 2010.

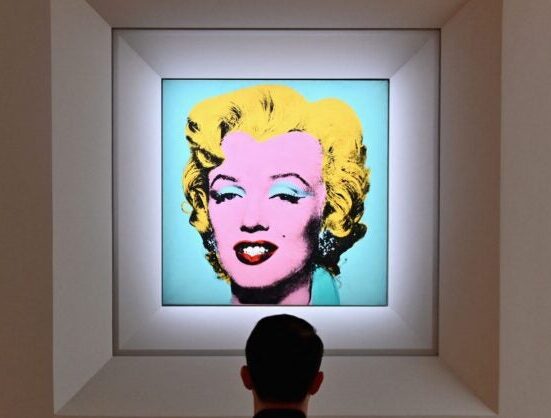

Pop culture icons often end up as collectibles that appreciate over time. Rare comic books featuring Spiderman, Hulk, and the Fantastic Four have joined stamps and baseball cards as collectibles that appreciate. It is difficult to predict what the next million-dollar collectible will be, so you or your estate might get lucky—don’t bank on it paying for your retirement. But feel free to hang on to the stuff you love and hold dear.

A good example of a mass-produced item being marketed as a collectible can be found in the Beanie Baby fad of the 1990s. Ty, the product’s manufacturer, produced hundreds of small plush toys with a floppy, bean bag-like feel. Consumers went crazy over them, believing they would become valuable one day. Limited editions that were hard to find became valuable the instant they were released due to resellers snapping up the refreshed stock. However, most of the plush toys were so widely owned that they never became valuable, becoming garage sale castoffs instead, although a few became worth money to some collectors.

If collectibles are sold at a profit after more than one year of ownership, you will be subject to a long-term capital gains tax rate of 28%.

Where Can I Sell My Collectibles?

Online marketplaces make it is easy these days to sell collectibles. Aside from the obvious eBay, you can sell your collectibles on websites like Etsy, Craigslist, Facebook Marketplace, Bonanza, Ruby Lane, and ArtFire. Even e-commerce giant Amazon even has a thriving collectibles market.

Local swap meets, flea markets, and collectibles stores offer a face-to-face way to sell your collectibles.

Where Can I Sell My Coca-Cola Collectibles?

Coca-Cola collectibles are regularly bought and sold on big online platforms like Facebook Marketplace and eBay. Of course, Coca-Cola collectibles remain very popular, so selling them through local classified ads or at a flea market should be a relatively easy process.

Where Can I Sell Avon Collectibles?

Both Facebook Marketplace and eBay have robust markets for buying and selling Avon collectibles.

What Collectibles Are Hot Right Now?

As of summer 2021, Pokémon trading cards are particularly hot. BBC recently reported that a sealed box of Pokémon cards from the late 90s, which retailed at around $100 back then, is now worth upwards of $50,000. The sports card trading market was on fire in 2020, with returns that have even topped the S&P 500. Thanks to restless stay-at-home boredom, demand for both Pokémon cards and sports cards have largely been fueled by the economic crisis and lockdown.

The Bottom Line

The best way to start investing in collectibles is to choose collectibles that excite you and that you’re passionate about. Then, do as best as you can to only buy from reputable dealers and sellers with a track record of good reviews. Finally, be sure to start small.