As the owner of two galleries in Paris and another in Brussels, Nathalie Obadia’s goal is to not only follow the latest trends in art, it’s also to set the agenda.

“It’s influencing the influencers, the tastemakers,” Obadia said about her work running the galleries that bear her name.

Obadia, a graduate of the elite Sciences Po and author of “Géopolitique de l’art contemporain” (The Geopolitics of Contemporary Art), also wields her influence in another way—as a member of the French art gallery association, staying in regular contact with the various heads of cultural ministries, and the senators and deputies in the legislature responsible for the art world so that when an issue arises, they will listen to her.

For 2023 the issue has been one tied to France’s dominance in the art industry in Europe, as well as the entire economy that exists to support artists and the galleries that sell their works: the tax rate on art sales.

The current VAT rate on most art sales in France is 5.5%, but the French art industry feared that the rate would rise as high as 20% under a European Union directive that passed in 2022 in an attempt to standardize VAT rates across the bloc.

Typically, collectors bring in a piece of art through the EU country with the lowest VAT import rate, which was the UK before it left the European Union, said Davide Bleve, a tax partner for Deloitte Italy.

A European art collector who wants to acquire a piece of art from an auction house, such as Christie’s or Sotheby’s, or from another source in a country outside of Europe, can select any of the member states to import the piece of art, regardless of the final European destination, said Bleve. France took advantage of the vacuum left by the UK to establish itself as the EU country on mainland Europe with the lowest art taxes, propelling the country into the top art market in Europe.

Obadia, her gallery association colleagues, and representatives of artists and art fairs spent the better part of 2023 lobbying France to codify a preferential rate of value-added tax on art sales to keep the country and its galleries on top in Europe.

“I don’t expect gallerists to have yellow vests on by the Arc du Triomphe and set fire to it,” Claude Herrmann, the managing director of Luxembourg-based Fortius, a fine-arts storage and logistics company, said about the French. “But in a more subdued way, they will be very vocal about this, and they have the most to lose because it’s the biggest market in the EU, in Europe for art.”

The French gallerists acted before many of their peers in neighboring member states were even aware of the opportunity and threat of changes to the VAT system.

“In Europe, of course, any country that takes the first step then becomes the leader,” said Marion Papillon, the current president of the Comité Professionnel des Galeries d’Art.

Just before the end of the year, their advocacy paid off. The 5.5% VAT rate will apply to all art transactions in France, effective beginning Jan. 1, 2025.

VAT Rules

European Union finance ministers approved at their April 2022 gathering an update to the value-added tax rules, which were first created nearly two decades ago. The new directive would phase out reduced VAT rates for fossil fuels by 2030. It would also give the bloc’s countries “flexibility” to apply reduced rates on other goods and services, according to the directive.

Currently, EU countries must apply VAT of at least 15% but can apply two reduced rates of at least 5% on products and services listed in the EU VAT Directive (2006/112/EC). The new rule, which goes into effect Jan. 1, 2025, creates two additional reduced VAT allowances, one zero percent rate and one rate between zero percent and 5%.

The April 2022 EU directive led to an uptick in lobbying around the art VAT rate in member countries.

The directive in working toward a harmonized VAT rate takes two steps that affect the art industry, according to Herrmann. The first is updating and clarifying the limited number of types of goods and services where you can apply a reduced VAT rate, leaving each country to choose among the catalog of services and products that they want to include in this reduced VAT rate.

“Much more importantly, and much more obscurely, the directive has a direct impact on the margin sales, which are always predominant in the art market. Even new-from-artists stuff is mostly sold under the margins,” said Herrmann. In margin sales, the VAT is applied only to the gallery’s profit from a sale, not the final price (some countries also allow the deduction of costs such as publicity or marketing materials, among other items).

France’s margin sale rules, for example, result in an effective tax rate of around 6% on a sale of art, said Herrmann. That could change under the new directive, which gave countries a choice: Art, whether it is contemporary or part of the secondary market, can only benefit from either a reduced VAT or a VAT applied only to the margin. So, keep your margin scheme, but increase the VAT to the full rate. Or drop the margin scheme and opt for a lower VAT rate. It’s up to the member state.

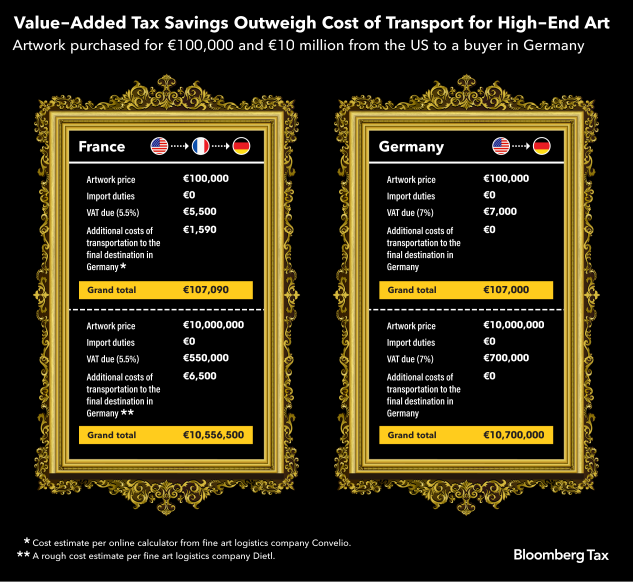

The VAT rate is a less significant decision when the art costs 100,000 euros compared to 10 million euros. At 100,000, the extra cost of transporting a hypothetical painting in a 6-foot storage crate from France to a location in Berlin is about 1,600 euros, according to a calculator from fine art handling and shipping company, Convelio. When you calculate the VAT, it’s more expensive to ship to France and transport it to Germany than the value difference in the VAT in that scenario.

But for a high-value painting, the cost of transportation, even if it requires special insurance, a personal driver, and a security detail, doesn’t outweigh the cost-savings from the VAT rate difference.

“The trucking costs from Paris to Berlin are negligible versus the savings on import VAT in the case of a 10 million painting,” said Herrmann.

Lobbying in Europe

The new EU rule poses a risk of higher taxes on art. But the directive also creates an opportunity for renewed lobbying by the art industry, especially in countries such as Italy and Greece, among others, where galleries don’t benefit from a reduced VAT, said Philip de Jong, chairman of the Dutch Art Association and president of the Federation of European Art Galleries Association.

Italy has a reduced import VAT rate of 10% but taxes other sales of art and art-related goods at the full rate of 22%. The country is now considering dropping its own import rate to match France at 5.5% and then applying that rate to related art transactions, according to the 2023 biennial Art & Finance Report from Bleve of Deloitte.

But the Italian proposal remains just that, according to Bleve.

Even in countries with a reduced VAT rate, there’s lobbying underway. Luxembourg, where Herrmann of Fortius is based, has a 7% reduced VAT rate, but perhaps the number could be lower, he said.

“We’re lobbying as well, through the association, both for the local art market and as well for our own purposes and have ours included in the low-end reduced VAT rate and be also having it as low as possible,” Herrmann said.

Impact on Artists

A higher tax rate would increase the acquisition price of the works and would drive down the volume of business, which in the end would mean less support for artists, Obadia said.

“You have to explain that it’s not just a story of the rich, art. It’s an economy,” Obadia said she told her fellow working group participants and the government leaders present.

Lawmakers can forget the importance of the artist to the industry, especially when they look at galleries as just another commercial organizations, said de Jong.

“It’s in fact the artists that are the target group of the lower VAT rate, not the gallery. Galleries can only use it if they act as agents for the artists,” de Jong said.

This was the point the the French gallery association and other art industry groups began making this spring.

In March, representatives from the French galleries and artist groups met with not just the Ministry of Culture, but also the Ministry of the Economy, Finance and Industrial and Digital Sovereignty.

The March meeting was followed by several formal working groups. The gallery group commissioned a report from Dr. Clare McAndrew, a regular author of reports on the state of the art market for Art Basel, the industry gold standard.

The artists brought their receipts. They offered the government leaders the sorts of numbers that drive policy change—jobs and budget impacts. The French art market supports about 30,000 French artists, but also people in related specialized ancillary industries, the report states, including 61,600 direct jobs in the sector and 111,275 indirect jobs in the broader market (artists, museums, fairs). Those figures put the industry on par with publishing and marketing in France.

In the event of an increase in import VAT and artists’ VAT to 20%, the potential loss of VAT could conservatively amount to 74 million euros ($81.3 million) or closer to 139 million euros if the market tanks, according to the report.

Echoes of Brexit

Art industry leaders in other member states are watching the French with wariness.

“I’m very afraid that it will cause competition,” said Rodolphe Janssen, a gallery owner in Belgium, pointing to French tax changes after Brexit. “I’m not sure that politicians, men and women politicians in Belgium or in other countries think in the same way.”

After Brexit, several member states discussed how to benefit from the departure of the EU and London’s dynamic art scene. Countries including France, Italy, Ireland and Luxembourg all considered changing their import VAT rate to capture a growing market. It was France, at the urging of the gallery association and other industry actors, that moved quickly to replace the UK, said Bleve.

France then became “the major place” where the collectors tried to import a piece of art thanks to its low rate of the import VAT and because the country made it easy from a bureaucratic and administrative standpoint, said Bleve.

In 2022 the import value of works of art accounted for 2.4 billion euros across the European Union, according to European Union trade statistics. France’s art imports accounted for about half of the EU total—the country hit a new record in 2022 at just under 1.2 billion euros in art imports, according to the McAndrew report.

Since Brexit, France has become the largest EU marketplace, representing 54% of sales in value, according to the McAndrew report.

France’s art industry wants to keep it that way.

“The French gallery association is the largest and most powerful throughout Europe,” said Janssen.

The gallerist Obadia said the other major European art powers such as Italy, Germany, are “very, very, very jealous,” of the French gallerists’ power. “They haven’t succeeded at building something as potent, as listened to, as influential.”

The French gallerists’ lobbying efforts paid off over the course of 2023.

In September, Rima Abdul Malak, the minister of Culture, announced that as part of President Emmauel Macron’s budget the margin system would be no more. Under Macron’s proposed budget all art in France would be taxed at 5.5% to bring the country into compliance with the EU directive.

“Often when we hear ‘the art market’ we think of the sales records for dealers at auctions. But behind it is a whole very diverse ecosystem with actors, intermediaries with art centers and museums, who also make acquisitions, with small galleries and with emerging artists,” said Malak during the September budget presentation, echoing the message brought to the government by the art industry. “So it is this entire ecosystem which will be preserved thanks to this measure.”

The gallerists wouldn’t declare victory, however, until the National Assembly passed the amendment to change the VAT rate through the budget that made its way through the French legislative process beginning in October and ending in the last days of December.

Macron’s government pushed through the budget law on Dec. 21 under a constitutional maneuver that allows the government to pass a bill without a vote. The amendment to change the VAT rate on art was one of 358 amendments that made its way into law in that way.

“It was really important for France to remain the leader and so they had to make a decision quickly,” said Papillon, the French gallerist association president. “In politics, quick is slow.”

Even if the process to codify the VAT change to benefit the French art industry took most of a year, it meant that in Europe, France was still first.