Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Good morning. Qatar said yesterday mediators had secured a deal to prolong the temporary truce between Israel and Hamas by two days to allow the release of more hostages held in Gaza.

The announcement on extending the original four-day pause to the Israel-Hamas war came as Benjamin Netanyahu’s government faced mounting pressure to provide more time for hostages to be freed. The truce had been due to expire on Monday.

The Palestinian militant group confirmed it had agreed to extend the pause in fighting by two days “under the same conditions as the previous truce”. Israel has not yet commented on the deal.

Majed al-Ansari, spokesperson for the Qatari foreign ministry, did not specify how many hostages would be released.

But negotiators had said earlier that, if the ceasefire were extended by two days, Hamas would release a further 20 women and children held in Gaza. In return, Israel would free another 60 Palestinian women and children held in Israeli prisons. Here’s what else we know about the truce extension.

Here’s what else I’m watching today:

-

HKMA-BIS high-level conference: People’s Bank of China governor Pan Gongsheng and Reserve Bank of Australia governor Michele Bullock speak at a gathering of central bank leaders in Hong Kong.

-

Nato: Foreign ministers of the bloc will meet in Brussels for discussions likely to focus on the Ukraine war.

-

China: The first China International Supply Chain Expo begins in Beijing.

Five more top stories

1. Exclusive: Some of the world’s biggest audit and consulting firms are asking staff to use burner phones when they visit Hong Kong. Deloitte and KPMG have advised some US-based executives not to use their usual work phones in the territory, a sign of the increasing difficulties global companies are facing in a city long known as an international business hub.

2. The United Arab Emirates planned to use meetings about the COP28 climate summit it is hosting later this week to pitch oil and gas deals to foreign governments, according to leaked briefing documents. Sultan al-Jaber, president of this year’s UN climate summit, has called for a “phaseout” of fossil fuels globally. But his position as head of COP28 while also leading the UAE state oil company Adnoc has attracted criticism for a perceived conflict of interest.

3. Christine Lagarde has said the European Central Bank is likely to discuss speeding up the shrinkage of its balance sheet by ending the last of its bond purchases earlier than planned. The ECB president’s comments yesterday are the clearest sign to date that the bank is preparing to further tighten monetary policy by reducing the amount of bonds it plans to buy next year.

4. Sumitomo Mitsui Financial Group chief executive Jun Ohta has died at the age of 65. Ohta spearheaded the Japanese bank’s recent wave of expansion in the US and south-east Asia. As well as building its recent reputation for aggressive foreign expansion, Ohta steered SMFG through a scandal at its brokerage unit over alleged market manipulation.

5. The vast tracts of desert in Western Australia have become a major battleground for miners of lithium, a key raw material for batteries as the world transitions to greener energy. Multinational companies have clashed with Australian mining billionaires for control over lithium’s “corridor of power”, sparking a deal frenzy in two of the remotest parts of the state.

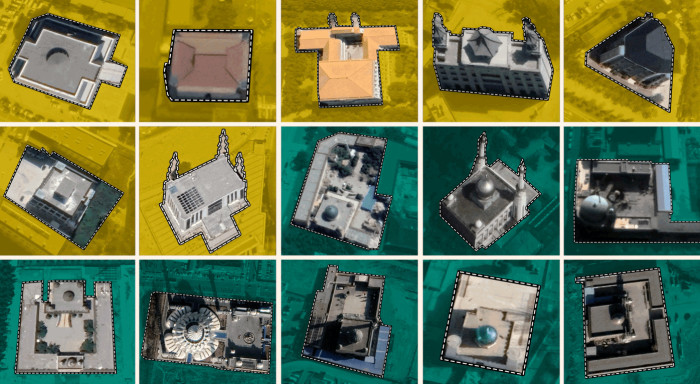

Visual investigation

Beijing has altered or destroyed thousands of mosques across China as the government broadens its suppression of Islam. While demolitions and modifications have been documented in Xinjiang, the north-western region where hundreds of thousands of Turkic Muslims have been detained, there is evidence that architectural changes have spread to almost every region of the country.

We’re also reading . . .

-

‘Forgotten war’: Gaza has pushed Ukraine off the front pages, but there is no sign of defeatism in Kyiv, writes Alec Russell.

-

OpenAI: Sam Altman has returned as chief executive after five days of chaos, but it would be a mistake to expect business as usual, writes Richard Waters.

-

Nearshoring hype becomes reality: Monterrey has become a leading example of Mexico’s ability to benefit from geopolitical instability, as manufacturers from China, South Korea and Japan move closer to US consumers.

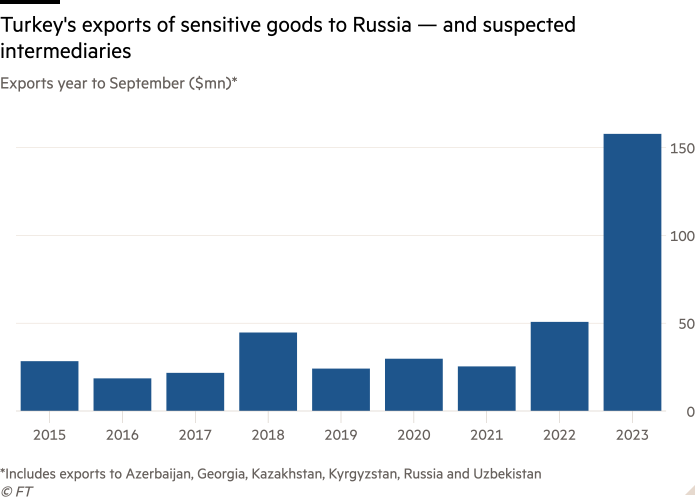

Chart of the day

Turkey’s exports to Russia of goods vital for Moscow’s war machine have soared this year, heightening concerns among the US and its allies that the country is acting as a conduit for sensitive items from their own manufacturers.

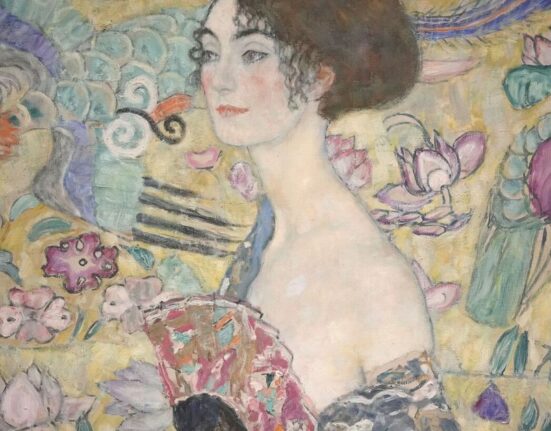

Take a break from the news

As interest in art from the Global South grows, there is particular focus on south-to-south exchanges. A new exhibition at National Gallery Singapore is billed as the first major comparative survey of art from South-east Asia and Latin America, examining how artists from both regions handled revolution and freedom.

Additional contributions from Gary Jones and Euan Healy