In a nutshell

Masterworks is an online fine art marketplace, where you can buy and sell shares in some of the top contemporary art pieces in the world.

- Fine art is an asset class once available only to the very wealthy. But Masterworks now makes it available to ordinary investors to hold in their portfolios.

- Most investors’ portfolios contain mostly financial assets like stocks, bonds and funds, which are good investments, but in recent years they have all correlated with one another, meaning they’re not adequately diversifying risk.

- A strategy to minimize risk is to invest in non-correlated assets, like fine art.

Masterworks investing synopsis

- Minimum investment: $15,000 for newly issued artwork but less for pieces on the secondary market.

- Investments offered: Fine art/paintings.

- Fees: 1.5% per year + 20% of profits on sale.

- Investment term: 3 to 10 years.

- Available accounts: Taxable investment accounts, traditional and Roth IRAs.

- Customer service: Phone and in-app email; no hours of availability are indicated.

Pros:

- Provides ordinary individuals the ability to invest in fine art, which traditionally has been restricted to the wealthy.

- Invest in fine art without taking possession of it.

- Limited marketplace where positions can be sold.

Cons:

- Art investments are illiquid, investments are long-term.

- High fee structure.

- Investors must rely on Masterworks for artwork valuation.

Masterworks investing overview

Fine art is one of the most unique of alternative assets. It’s a true alternative because it’s non-correlated with the financial markets. That means the price of fine art moves independently of the financial markets, holding the possibility of rising when stocks and bonds are falling.

Related: What to do when the stock market crashes

Fine art is one of the best examples of an alternative asset because it has long been held by the very wealthy. Masterworks makes it possible for ordinary investors to add a true alternative to a portfolio composed of financial assets only.

One of the biggest advantages of investing in fine art through Masterworks is that you don’t need to take physical possession of the art. You can instead purchase shares in one or more pieces of art, making holding it in your portfolio as easy as any financial asset.

Liquidity is a mixed bag with Masterworks, in that it functions as both a positive and a negative feature. On the positive side, Masterworks does offer an online marketplace where you can sell your shares at any time. But on the negative side, those shares can only be sold if there is a willing buyer. If not, you’ll need to hold your position until the underlying art has been sold. That makes fine art a long-term investment.

Since many investors are accustomed to commission-free trades on broker platforms with no monthly or annual fees, the fee structure on Masterworks can be a bit of a shock. They charge an annual fee of 1.5% of your portfolio value, which is charged in the form of reducing the number of shares you own. If you hold an art piece for 10 years, this will equal approximately 15% of your investment.

Masterworks also charges a selling fee equal to 20% of the profit on sold art. If you invest in a piece for $20,000, and five years later it sells for $30,000, you will pay $2,000 to Masterworks, while retaining your original $20,000 investment, plus an $8,000 profit.

Finally, one of the biggest limitations with fine art is that you will be relying entirely on Masterworks to provide adequate evaluation of your investments. Since fine art is a highly specialized asset, value can only be determined by experts in the field. Unless you are an expert, or have access to expert help, you’ll need to rely on appraisals provided by Masterworks.

Masterworks investing features and services

Masterworks is an online marketplace focused on fine art, more specifically, paintings. However, as an investor, you will not need to purchase an entire piece of art or take possession of it. Instead, Masterworks enables you to participate in individual art pieces by buying shares in each piece.

The minimum investment in any single piece of newly issued art is $15,000, though pieces purchased on the secondary market may be substantially less. Masterworks recommends you don’t commit any more than 5% or 10% of your total investment portfolio toward art since it is an alternative asset class. While it is high risk, given that returns are not guaranteed, the platform does not require accredited investor status to participate. Investing in Masterworks is open to all.

The company is based in New York City, and has more than 800,000 participants in over 390 art pieces, totaling more than $900 million in assets under management.

What Masterworks offers

Masterworks identifies “iconic artists.” These are artists whom the art market has determined to have the most momentum, meaning their work is gaining traction and rising in price. Masterworks purchases the art directly, though less than 5% of the art presented is ever purchased.

The artwork is acquired from major auction houses, private collectors and established galleries. Masterworks targets the top 100 contemporary artists.

They then securitize the artwork, filing an offering circular with the Securities and Exchange Commission (SEC). This filing enables anyone to participate in the investments. The shares are then made available on the Masterworks investment platform for purchase by investors.

Masterworks holds paintings for between three years and 10 years, making it a true long-term investment. However, it is possible to sell your shares without incurring any fees through the online marketplace. You can fund your trading activity on Masterworks through a brokerage account with Templum, which is a broker for alternative assets.

Selling on the marketplace is not guaranteed, since a sale will be possible only if there is a willing buyer. You should not purchase Masterworks art with the intention of disposing of it in a few weeks or months, or worse, engaging in frequent trading activity. Artwork is simply not sufficiently liquid to accommodate that type of activity.

After a holding period of up to 10 years, Masterworks will sell the art — hopefully at a profit. As an investor in the artwork, you’ll receive 80% of any profits, while Masterworks will retain 20%.

Investment performance

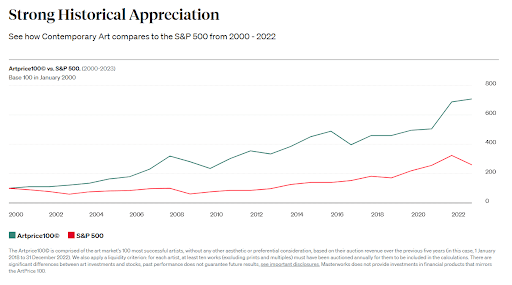

Masterworks publishes the following chart on the website demonstrating the difference in the performance of contemporary art compared with the S&P 500. Based on the chart, a $100,000 investment in 2000 would result in approximately $250,000 at the end of 2022 if invested in the S&P 500, while the same $100,000 invested in contemporary art would reach approximately $700,000.

The company publishes investment returns indicating contemporary art has provided an average annual return of 12.6% between 1995 and 2022. That compares very favorably with the 9% return on the S&P 500 over the same period.

Masterworks also publishes return results on artwork offered on the platform, and many are impressive:

However, notice as well that the performance of some pieces is admittedly lackluster. As with all investments, especially alternatives, there are no guarantees of future performance. While the history of fine art has been impressive, you should not invest in this asset class based on past performance.

Who is Masterworks investing best for?

Masterworks can be a good choice if you have a moderate to large investment portfolio, and you want to invest beyond financial assets alone. Because fine art is uncorrelated with the financial markets, it’s possible the asset class can perform well while stocks and bonds are in decline. It’s also possible fine art as a tangible asset will have a more favorable reaction to inflation than financial assets will.

Because of the large minimum investment required of $15,000, Masterworks is not suitable for small investors, especially if you’re looking for diversification among multiple pieces of artwork.

While you are not required to be an expert in fine art, it is important to do your homework and have familiarity with this unique asset class. It cannot be evaluated and valued the way you will with financial assets. Masterworks performs the evaluation of each piece, and even performs an updated appraisal.

If you choose to invest in fine art, it should occupy only a small slice of your total investment portfolio. Returns are unpredictable and not guaranteed. Your portfolio should emphasize financial assets, with a small allocation in fine art and other alternative asset classes held only as a diversification.

How Masterworks investing compares

There are other options for alternative investments if Masterworks isn’t the right choice for you.

Yieldstreet is perhaps the best-known online investment platform for alternative assets. In addition to art, Yieldstreet also offers alternative investments such as crypto, legal notes, private credit, private equity, real estate, short-term notes, transportation and venture capital. The minimum investment is $10,000, and you will be required to be an accredited investor for most investments offered. You’ll be tying up your money for between three months and six years, which is typical of alternative asset classes. Fees for these investments can be up to 2.5% per year.

Rally Rd is another alternative assets investment platform. You can invest in collectible assets, including sports memorabilia, books, cards, comics, cars and non-fungible tokens (NFTs). Much like Masterworks, you don’t need to take direct ownership of the assets, but instead purchase shares in them. Those shares can be purchased for as little as a few dollars. They can be bought and sold on the platform from or to other participating investors. Rally Rd does not require accredited investor status, however, they do not offer IRA accounts.

Methodology

This review is based on information provided on the Masterworks.com website, as well as third-party sources providing relevant information. Those third-party sources include the Better Business Bureau, Trustpilot and other sources.

We have not opened an account with the company and attempted to make art purchases on the platform.

Frequently asked questions (FAQs)

Is Masterworks investing legit?

Yes. Masterworks registers all securities sold with the Securities and Exchange Commission (SEC).

Masterworks has a Better Business Bureau rating of A+, the highest offered by that agency. They also have 4.2 out of five stars with Trustpilot, which is considered to be “Great.”

Is Masterworks investing good for beginners?

No. Masterworks has a minimum required investment of $15,000. Investing in fine art is also a unique investment class, and better suited to those who are familiar with the process. Though Masterworks does not require accredited investor status, this kind of investment usually does.

Related: Best investments for beginners

Does Masterworks investing charge a monthly fee?

No. The 1.5% annual fee is deducted once per year and is charged by reducing the number of shares you own in the artwork you hold in your portfolio. They do not offer the ability to pay the fee in cash.