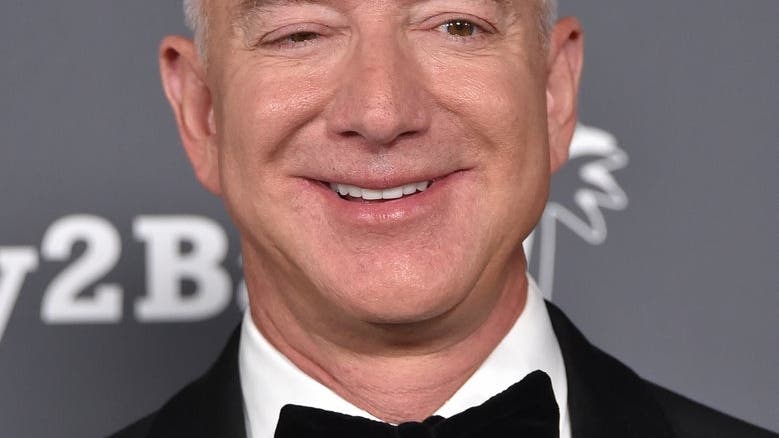

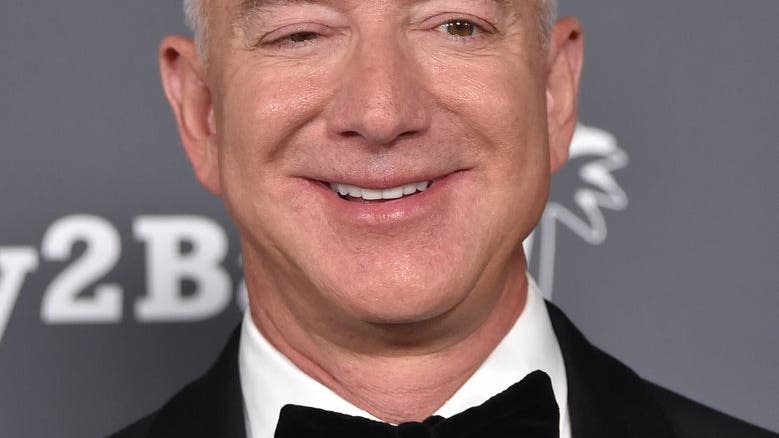

Jeff Bezos amassed his wealth through Amazon stocks and owns hundreds of millions of dollars worth of real estate, but one of his most valuable possessions may surprise you: art. Among his collection is the renowned piece “Hurting the Word Radio #2 (1964)” by Ed Ruscha, purchased by Bezos for almost $53 million. This artwork, a prime example of Ruscha’s text-based paintings, stands as a signature piece in Bezos’ collection.

As concerns over stock market volatility persist, the world’s wealthiest individuals, including not only Bezos but media mogul Oprah Winfrey and acclaimed actor Leonardo DiCaprio, are increasingly turning to art as a strategic investment avenue. Art investment, often viewed as exclusive to the ultrawealthy, offers a unique combination of cultural prestige and financial resilience. It has demonstrated remarkable stability, serving as a hedge against economic downturns, inflation, and currency devaluation. For billionaires like Bezos, art represents not just diversification, but a sophisticated approach to wealth preservation and capital growth.

Don’t Miss:

What Makes Art Appealing to Billionaire Investors?

Art investment holds a strong appeal for billionaires due to several critical factors:

-

Wealth Preservation: Art, as demonstrated by the works of iconic artists such as Pablo Picasso and Jean-Michel Basquiat, embodies enduring value, providing a dependable means of safeguarding wealth across generations.

-

Diversification: Unlike conventional financial assets, art frequently operates independently of stock markets. This independence offers stability during times of market turbulence, making art an attractive component of diversified investment portfolios.

-

Privacy: The discretion of the art market enables investors to execute transactions without the public disclosure requirements associated with securities trading. This confidentiality adds an extra layer of privacy to their financial activities, appealing to those who value discretion in their investment strategies.

Can Individual Investors See The Same Returns As The Ultra-Wealthy?

According to the UBS Billionaires Report 2022, 30% of billionaires possess art collections averaging $300 million in value. Despite these impressive figures, many wonder why more people don’t invest in art.

The reality is that most individuals lack the financial means to invest in art on such a scale. However, platforms like Masterworks are changing that. Masterworks, an award-winning platform, facilitates investment in multimillion-dollar paintings by renowned artists like Banksy and Picasso.

This accessibility is significant because contemporary art has consistently outpaced real estate, gold, and even the S&P 500 over the last 27 years. With Masterworks, investors can start diversifying their portfolios into art, following the footsteps of icons like Jay-Z, Oprah, the Royal Family, and Jeff Bezos himself.

Embark On Your Art investment Journey With Masterworks Today

For those looking to follow in the footsteps of billionaire art investors, Masterworks offers a gateway to the art market. By democratizing access to art investment, Masterworks enables individuals to partake in the financial and cultural rewards of art ownership, once thought to be beyond reach. This shift not only expands the community of art investors but also reinforces the role of art as a vital component of a comprehensive investment strategy.

One of the standout features of Masterworks is its user-friendly platform, which caters to investors at all experience levels. The platform simplifies the process of investing in art, offering detailed investment theses for each painting and providing price appreciation metrics for similar works.

Masterworks makes it feasible for more people to start investing in art with any amount they choose, making it a great way for any investor to diversify their portfolio.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Jeff Bezos’ Most Prized Possession Breaks Historical Auction Records At Almost $53 Million originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.