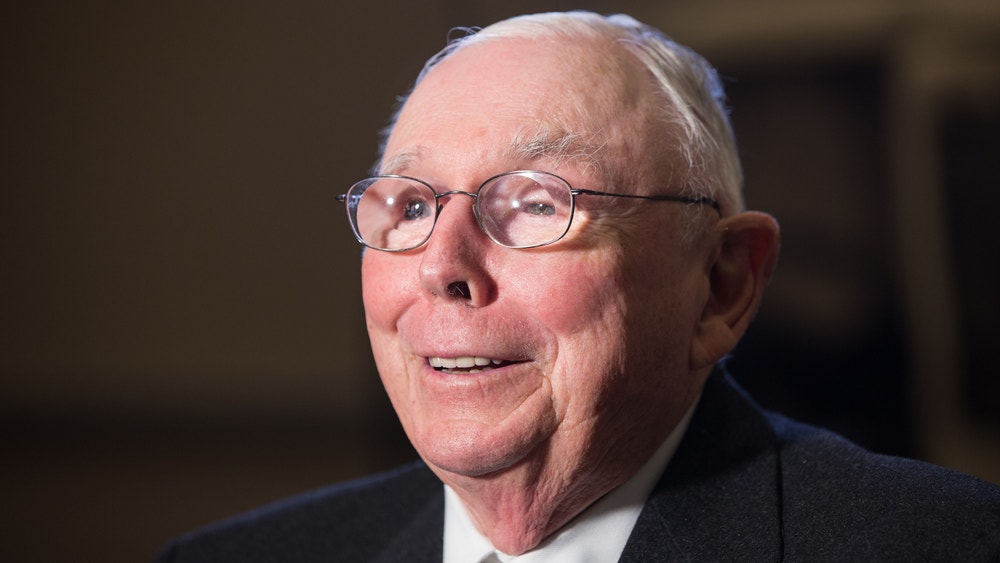

At age 99, Berkshire Hathaway Inc. Vice Chairman Charlie Munger’s life spans pivotal eras of economic transformation.

From the depths of the Great Depression to the financial tremors of the Great Recession, he’s seen it all. Munger recalls a time when the minimum wage was 40 cents per hour. Such experiences, set against a backdrop of technological evolutions and geopolitical gyrations, have provided him with a unique lens through which he views investing. Today, Munger is one of the most esteemed figures in finance.

How To Spot Investment Opportunities: Get in early. It’s been said that 90% of the world’s millionaires built their wealth through real estate. Now it’s your turn. Browse private market real estate offerings with minimum investments as low as $100.

During his tenure at Berkshire Hathaway, Munger has been at the epicenter of global economic changes. He’s been privy to the aftereffects of fluctuating inflation rates, watched industries rise and wane and observed the transformative impacts of technological revolutions. But amid this whirlwind of change, his investment philosophy has remained consistent and anchored in foundational principles.

At the heart of Munger’s philosophy is the concept of intrinsic value.

Expand Your Portfolio: Unlock the potential of art as an investment asset like tech billionaires do. See why Paul Allen’s personal art collection sold for $1.6 billion and discover how more tech moguls are turning to art for growth investing.

“I’m always just looking for something that’s good enough to put Munger money in. Or Berkshire money in or Daily Journal money in,” he said.

This sentiment underscores his pursuit of assets with genuine, inherent value, steering clear of ephemeral market trends.

His perspective on investments is shaped not just by data but by a broader understanding of life’s rhythms. Munger pointed out,

“If you’re going to invest in stocks for the long term or real estate, there will be periods of agony and others of boom,” he said.

Just as the world experiences the alternating cycles of day and night, investments oscillate between peaks and troughs.

Read Next: Hedge funds intend to snatch all pre-IPO shares of future AI unicorns before you can. But there is one venture product investing on your behalf.

Drawing inspiration from the iconic poem “If—” by Rudyard Kipling, Munger said, “As Kipling said, treat those two impostors just the same. You have to deal with daylight and night. Does that bother you very much? No. Sometimes it’s night and sometimes it’s daylight. Sometimes it’s a boom. Sometimes it’s a bust. I believe in doing as well as you can and keep going as long as they let you.”

This philosophical grounding speaks to his advocacy for patience, resilience and perseverance in the investment journey.

While traditional avenues like stocks and real estate have been mainstays, the investment landscape is vast. Startups, teeming with potential, represent the frontier of innovation. The ventures come with their share of risks but offer the allure of substantial rewards. However, success in this sphere demands meticulous research, due diligence and an understanding of evolving industries. In recent years, art has carved a niche for itself as a distinctive investment avenue. Traditionally the domain of the affluent, art’s accessibility has broadened, thanks in part to new platforms allowing you to invest in shares of artwork that have outperformed the S&P 500.

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article At Age 99, Charlie Munger Has These Words Of Wisdom For Investors: ‘Sometimes It’s A Boom. Sometimes It’s A Bust.’ Here’s How To Spot The ‘Boom’. originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.